System accounting divided into two subsystems: financial accounting and management accounting.

Financial accounting Is a system for collecting and processing accounting information necessary for compiling financial statements... Financial accounting includes information on the accounting of balance sheet accounts: fixed assets - intangible assets, financial investments, inventories, cash, and is used not only within the enterprise, but also by external users. Financial accounting is regulated by regulations.

Target financial accounting - formation of information about the activities of the organization as a whole: income and expenses, the state of funds, accounts receivable and accounts payable, payments to the budget and off-budget funds, on financial investments, financial results, etc.

Financial accounting subject- economic activity of the enterprise.

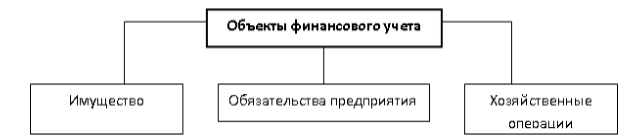

Objects are property (economic assets, assets of the enterprise), capital and liabilities of the enterprise (sources of formation of property), as well as business transactions that cause changes in property and sources of its formation.

Financial accounting principles.

1. The principle of monetary expression - accounting operates with data that have monetary value.

2. The principle of enterprise autonomy - the company's accounting accounts are independent from the accounts of its owners and employees.

3. The principle of continuity - the enterprise works indefinitely.

4. The principle of materiality is not to waste time on taking into account insignificant facts.

5. The principle of conservatism - when choosing, the accountant chooses the amount that is less optimistic.

6. The principle of constancy - during one reporting period you need to use one form and method of accounting.

7. The principle of the national currency - in accounting, the method of assessing funds in a constant currency is applied throughout the reporting period.

8. The principle of cost - funds are valued at cost at the time of acquisition, and not at market value.

9. The principle of implementation - enterprises take into account their income at the time of shipment of goods, and not at the time of payment.

10. Principle of correspondence - profit - revenue of the reporting period - the costs of this period.

11. The principle of duality - the principle of balance, when accounting information is considered according to the composition of funds and the sources of their formation: the totality of all funds (asset) is equal to the totality of sources (liability); principle double entry: a business transaction that changes the composition of funds and sources of formation does not violate the principle of balance.

Financial accounting tasks.

1. Formation of complete, reliable information about the activities of the enterprise required by users.

2. Providing users with information to monitor compliance with legislation, appropriateness business transactions, the presence and movement of property and obligations, the use of material, labor, financial resources in accordance with the approved standards.

3. Prevention of negative business results.

4. Identification of on-farm reserves to ensure the financial stability of the enterprise.

The basis for the analytical and planned work of organizations is Accounting... Accounting defines and systematizes data on the economic activities of the enterprise. Methodologically and organizationally, accounting is divided into financial and managerial.

Picture 1.

Definition 1

Financial Accounting is a set of rules and procedures that ensure the preparation and provision of information on the financial condition and performance of the enterprise in accordance with the requirements of legislation and accounting standards. Financial accounting data is the basis of financial reporting, is not a trade secret and is intended for internal and external users.

Remark 1

In financial accounting, in accordance with the principles and standards of accounting, all transactions are reflected in the accounts and in the balance sheet in a single monetary value.

The financial statements reflect financial condition enterprises, results of activity. The main task of financial accounting is a reflection of business transactions that were carried out at the current time. Financial accounting is mandatory for all business entities.

Organization of financial accounting provides:

- integral and continuous reflection of business transactions carried out in the reporting period;

- integral preparation of statutory financial statements;

- reliable information for users.

The objects of financial accounting, reflected in the corresponding accounting accounts, are (Fig. 1):

- organization assets;

- debt, other assets;

- sources of own funds;

- obligations (liabilities) of the organization;

- income and expenses of the enterprise;

- financial results of the enterprise and their distribution.

Figure 2.

Financial accounting is carried out on the basis of principles and standards accounting.

Financial accounting principles represent the basic concepts that serve as the basis for reflecting in the accounting and reporting of operations carried out by the organization, its income, expenses and financial results. The application of accounting principles allows you to prepare financial statements and ensure the reliability and quality of information for assessing the financial and economic activities of the enterprise.

Accounting standards represent normative document, which defines the rules and procedures for accounting and reporting. Thanks to them, accounting is built according to uniform rules.

Financial statements

Financial (accounting) statements of organizations are prepared on the basis of data from synthetic and analytical financial accounting.

Definition 2

Financial statements- These are interconnected generalizing indicators that reflect the real financial condition of the enterprise. The official financial statements include:

- balance sheet,

- Profits and Losses Report,

- cash flow statement,

- various applications.

Balance sheet is a statement of financial position of an organization, which reflects assets, liabilities and equity in monetary terms at a specific date. The balance is formed in accordance with the "Chart of accounts of accounting".

Profits and Losses Report characterizes the financial condition of the enterprise. It contains information about the formation of the financial result of the organization. This report allows you to determine and analyze the profitability of the enterprise. The income statement consists of items of income and expense. They are grouped according to the nature and main types of income and expenses.

Income reflects growth economic benefits for the reporting period in the form of an increase in assets or a decrease in the size of liabilities, leading to an increase in equity capital, except for growth associated with contributions from shareholders.

Expenses reflect a decrease in economic benefits in the reporting period, expressed in a decrease in assets or an increase in debt. This fact leads to a decrease in equity capital, except for those related to the distribution of part of the income between the owners of capital.

Unlike the balance sheet, which reflects the value of assets and liabilities at a certain moment, the statement of financial results records the movement of financial flows as input, i.e. income and weekends, i.e. expenses for a certain period.

Cash flow statement serves as a source of information about the sources of receipt of funds, about the directions and purposes of their spending, about changes in the balance of funds for the reporting period. Cash flow is reflected in the statement of current activities, investment activities and financial activities. This allows us to assess the rationality of the use of funds and make a forecast for the further development of the enterprise.

In addition to the main forms of financial reporting, there are reporting annexes ... They contain analytical information on individual reporting items.

Financial statements are prepared on an accrual basis. According to it, the results of all transactions are recognized upon their completion, and not upon receipt or payment of cash or cash equivalents.

All business transactions are reflected in the accounting records and included in the financial statements of the periods to which they relate. Financial statements prepared on an accrual basis provide information to users about past transactions related to the payment and receipt of cash and commitments to pay cash and cash equivalents in the future, as well as resources to be received in the future.

Thus, it provides information that is very important for users when making economic decisions.

Differences and features of financial accounting

Classic definition financial accounting states: “financial accounting is a system that measures, processes and transfers financial and economic information about a certain economic entity ". This information enables users to "make informed decisions when choosing alternative options for the use of limited resources in the management of the business of the firm." Usually speaking about financial accounting, information users can mean financial or management or accounting. But there are differences between these accounting systems, although at present in Western practice there are no differences between accounting and financial accounting, and management accounting is interpreted by some financiers as a special case, an organic component of financial accounting, although no one rejects the postulate that management accounting performs functions other than financial accounting. Consider the differences between the above accounting systems from the point of view classical theory finance, especially since these differences are fundamental for the Russian accounting practice. Defining the theoretical concept, we can say that financial and accounting is necessary to calculate the results of economic activities of a particular enterprise. The methods of this calculation can be different. Since most countries, including Russia, consider it necessary to tax profits, and for the purposes of the fiscal (tax services) the amount of profit received by the enterprise is fundamentally important, the state imposes certain restrictions on the choice in the accounting methodology of its calculation. We can say that accounting based on the system of registration of business transactions, storage of accounting documents, analysis, interpretation and use of information for fiscal purposes, which is strictly regulated by the state, is accounting. But the owners, the administration of any functioning enterprise, creditors, investors also evaluate the success of the company by the amount of profit received. However, the administration or the owners may have their own goals, and they do not always coincide with the goals of the tax authorities. Therefore, in order to calculate the economic result in this case, the administration can choose other methods (other methods of depreciation, peculiar methods of calculating finished products and services, etc.) and organize, in addition to accounting, its own financial accounting. Profit calculated according to financial accounting data does not coincide with its value shown in accounting. This is not falsification of data, as our tax services sometimes believe, but a conscious open approach to achieving various goals - the calculation of taxable amounts and the administration's assessment of the results of its work. Financial accounting is not a surrogate substitute for accounting, although both accounting and financial accounting are based on the main international and Russian accounting standards. In addition to the main task of financial accounting, and this is obtaining and summarizing adequate economic information about the activities of a company, group of companies or holding structures, regardless of the type of activity, financial accounting is also interested in identifying trends based on the information it processes and the effect of various alternatives, which is not typical accounting in principle.

Most businesses also use non-financial information. To meet a variety of information needs, management accounting is usually created. The management accounting system consists of interconnected subsystems that provide the information necessary to manage a firm or a group of companies, with the financial subsystem being the most important, since it plays a leading role in managing the flow of economic data and sending it to all divisions of the company. The purpose of management accounting is to provide information to managers responsible for achieving specific goals. Financial and accounting information created and prepared for use by management or external users is governed by different rules than information intended for internal users working directly in the firm and making decisions. Let's consider the differences between management, accounting and financial accounting. The comparison is mainly focused on: the main consumers of information, the types of accounting systems, freedom of choice (restrictions), the meters used, the main objects of analysis, the frequency of reporting, the degree of reliability of the information received. The comparison results are shown in Table 1.

Table 1

Comparison of financial, accounting and management accounting

|

Comparison areas |

Financial Accounting |

Accounting |

Management Accounting |

|

1. Main consumers of information |

Individuals and organizations both inside and outside the business unit with direct and indirect financial interests |

Individuals and organizations outside the business unit with direct and indirect financial interests |

Different levels of in-house management |

|

2. Types of accounting systems |

Dual recording system |

Dual recording system |

Not limited to double entry system; any system is used that gives a result |

|

3. Freedom of choice |

Mandatory adherence to generally accepted accounting principles, regulated within the company accounting policies |

Mandatory adherence to generally accepted accounting principles, regulated by legislative acts |

There are no norms and restrictions; the only criterion is suitability |

|

4. Used meters |

Monetary unit at the rate in effect at the time of occurrence of the fact of economic life |

Any suitable monetary or natural unit of measurement: man-hour, machine-hour, etc. If valuated in dollars, the actual or future value of the dollar can be used. |

|

|

5. The main object of analysis |

Business unit as a whole and profit centers |

Business unit as a whole |

Various structural subdivisions of a business unit |

|

6. Frequency of reporting |

Periodically, on a regular basis |

When required; may not be compiled on a regular basis |

|

|

7. Degree of reliability |

Requires objectivity; historical by nature |

Depends heavily on planning goals; but when required, accurate data are used; futuristic in nature |

Main consumers of information

Users of financial information can be divided into approximately three groups:

1) those who manage the enterprise, i.e. a group of people in a company that is fully responsible for managing the company's activities and achieving the goals of the company;

2) those who are outside the enterprise and have direct financial interests in it, i.e. a group of potential or existing creditors or investors;

3) those persons or agencies that show an indirect financial interest in the enterprise (consultants, contractors, regulators, employees).

The consumers of traditional accounting reports are outside the firm that prepares the report and whose management is responsible for compiling it.

Internal analytical reports are used by the administrators of the firm itself. The content of these reports will vary depending on their intended purpose and the role of the administrator for whom they are intended. Examples of such reports are: analysis of the state of warehouse balances; current operational sales reports, reports of the center of responsibility (work site) - to assess the result of work; reports on incurred costs - for making short-term decisions; analysis of the cost estimate - for the purposes of long-term planning, etc.

Types of accounting systems

Accounting reports prepared for an external source are compiled in a cost estimate and reflect the balances of all accounts included in the general ledger of the firm. Before entering data into the general ledger, it must be encoded into the form required for a double entry system.

The recording of financial information within the firm must be based on a double-entry system, or information may be collected by section or division of the firm.

Management accounting information can be reflected in various units of measurement, not just in valuation. It should not accumulate in the general ledger accounts. It is being prepared for the specific needs of administrators, and this is where its use ends. In this state of affairs, the information storage system and the search system must have more capacity than is required for financial accounting.

freedom of choice

Financial and accounting records are based on generally accepted accounting standards and principles that govern the recording, measurement and transmission of financial information. Generally accepted accounting principles, which are necessary primarily to protect the interests of the state and creditors, to ensure confidence in the information received, limit the choice of an accountant or financier to a finite number of accounting techniques and methods. Management accounting has limitations only in the applied techniques and methods, which should provide useful information. In each case, it is decided what information will be useful to the recipient, and then the necessary techniques and methods are selected. There are many approaches to solving the problem of the adequacy of information, and it is necessary to choose the method that should be the most accurate under the circumstances. Since the information is intended only for internal use, there is no need to adhere to any specific rules when recording the facts of economic life.

Meters used

Financial or accounting performs its functions by providing information about the business processes that have taken place. The information is measured in the accounting currency, more precisely, in the "historical" currency in which business transactions were carried out. At the same time, financiers are not limited to the use of "historical" currency and can use any other measure that is suitable in a given situation. Historical currency can be used for a short period of time to monitor cost levels and to analyze trends in ongoing planning tasks. However, most of the management's decisions are based on calculations using an assumed “future” currency. Basically, these decisions require predictive information and forward-looking estimates of current data and must rely on projected estimates of the future exchange rate. This is a feature of financial and management accounting. Management accounting also uses metrics such as man-hours, machine-hours, and production units or measure of work performed in its analysis. A common measure underlying all activities in metering, reporting and analysis in management accounting is the usefulness of the meter in a given situation.

Main object of analysis

Financial and accounting records summarize the operations of the entire firm. Management accounting usually includes an analysis of the activities of various divisions (cost centers; structural divisions, the results of which are measured by the profit received, - profit centers; divisions or functional departments of the company) or any aspects of its activities. Reports can cover both the analysis of income and expenses of the entire department, and the accounting of funds used by a particular department.

Reporting frequency

Accounting reports prepared for external use are submitted regularly in accordance with the rules approved by law. Financial reports are also submitted regularly, but in accordance with the company's accounting policy: monthly, quarterly and / or annually. Periodic reporting, compiled at regular intervals, is the basic principle of financial and accounting. In management accounting, reports can also be prepared monthly, quarterly and / or annually on a regular basis or even daily, but this is not necessary, since the main thing is that each report is useful to its recipient and presented to him at the right time.

Reliability degree

Financial and accounting information included in financial reports, covers the actual data summarized for the consumer. This information reflects transactions that have already been completed and for this reason is objective and verifiable. Management accounting is primarily concerned with the control of internal operations. Management decision-making is an activity that is more focused on the future. Historical transactions, while useful for identifying trends, are usually immaterial in planning and should be replaced by subjective estimates of future expected events.

Seven areas being compared should help move from accounting to finance and from financial to management. In many cases, financial and management accounting data are related to the profitability of the company and are intended only for management. Leaking such information can make the competition in the market unfair. Thus, if financial accounting focuses on complete and accurate explanation and disclosure of the results of the firm's operations, then management accounting seeks to help management achieve its goals.

Conceptual methodological norms and principles of financial accounting

The methodological principles of financial accounting for any company are based on the main international and Russian accounting standards, based on the specifics of financial and economic activities. Applying these principles makes it easier to understand the essence of financial accounting. When using specific methodological techniques of financial accounting and the formation of reports of all levels, the CFO can, at his choice, be guided by all or some of them.

1. The principle of the business unit, or the principle of accounting for the centers of profitability.

The success and survival of any company in a highly competitive environment requires a focus on two main goals: profitability and liquidity. Therefore, the question arises of identifying the centers of profitability within the framework of the company's activities. The activities of any company, even a small one, can be divided into directions, that is, determine the centers of profitability. In a trading company, these can be sales departments (wholesale or retail), products and services with different consumer properties, brands within a homogeneous assortment, retail sites or stores, customers of various categories, in production these are workshops, products with different consumer properties. Groups of companies, holdings and large companies also have centers of profitability. These are subsidiaries, branches, that is, some business units. Using the principle of a business unit (the principle of accounting by centers of profitability), each line of business or subsidiary should be considered as an economic business unit, separate from other business units, which will allow identifying the most profitable centers, as well as making more informed decisions within the framework of activities business units, and ultimately more successful in managing the company as a whole.

This principle is based on property isolation: a business unit conditionally or unconditionally owns some of its own funds, represented by property in cash or in kind.

In the course of economic activity, the volume of property in monetary terms changes due to a corresponding change in the liabilities or own funds of the business unit.

2. The principle of going concern.

This principle is based on the assumption that each business unit is functioning normally and there is no intention to liquidate or significantly reduce its activities. That is, the enterprise, once it has arisen, will exist forever. This is a very peculiar principle, because it contradicts common sense: every person knows that he will die, especially any factory, store, salon, etc. cannot exist permanently. And nevertheless, this principle is put forward among the main ones. The accepted assumption, which is reminiscent of the first law of mechanics, makes it possible to calculate financial results very efficiently and to abandon senseless attempts to revalue the considered objects. Indeed, if an enterprise has existed forever, why revalue its assets? On the contrary, if an enterprise is liquidated, then its inheritance should be valued at the current market value, and not by their historical value.

3. The principle of periodicity.

The principle of periodicity means that the main financial planned and actual indicators are calculated at strictly defined points in time, set equal to the calendar month, quarter, half year, year. In addition, this principle allows us to consider the reporting year only as related to the peculiarities of the business cycle and not to tie it to the calendar year. Each branch of the national economy has its own cycle, and, therefore, the financial director of each enterprise has the right to choose the dates of the economic year for his company.

4. The principle of accrual.

The accrual principle is one of the basic principles and is implemented in the assumption of the temporal certainty of the facts of economic activity.

Temporal certainty is expressed by the following fundamental rules:

A. Compliance rate.

All costs are divided into 3 main groups:

- current costs of core activities related to income generation;

- costs for capital investment, that is, the cost of the acquisition (in any form), as well as the reconstruction and renovation of fixed assets, directly or indirectly involved in the process of core activities;

- financial investments, which are expenses for the acquisition of financial assets (stocks, bonds, participation interests, promissory notes, etc.), including the provision of long-term loans, made for the purpose of generating income not related to the main activity or other, determined by the company's management, purpose.

Current costs are subdivided into:

- direct, which can be attributed to a certain type of activity;

- indirect, which arise when a business unit conducts economic activity, but which cannot be unconditionally tied to its specific type.

Direct costs can be conditionally variable, the size of which depends on economic activity in a particular activity (according to a linear or other increasing function), and conditionally constant, which arise regardless of the level of economic activity in this activity.

Indirect costs, as a rule, are always nominally fixed.

For financial accounting purposes, the compliance rate is defined as the need to reflect the direct costs of generating income in the same period as the income for which they were generated.

Accordingly, in a certain period, only those direct costs are reflected that led to the formation of the income received in this period.

At the same time, it is assumed that indirect costs are to be attributed to a decrease in the financial result in the reporting period when there is confidence that they will be incurred, or, depending on the chosen accounting policy, when they were actually paid (cash method).

Capital and financial investments are not attributed to the reduction of the financial result of the reporting period, when they were made, and are carried over to current costs in accordance with the accounting policy.

B. Rate of accrual.

The accrual rate determines that expenses and income are recognized in the reporting period to which they relate.

In this case, income and expenses are reflected in financial accounting only if there are primary documents that allow you to accurately determine their size.

B. rate of registration of income.

This rule stipulates that for the recognition of proceeds from sales, the following are required:

- transfer of ownership;

- the ability to assess income with a significant degree of accuracy;

- completeness of activities to receive proceeds;

- confidence in the impossibility of canceling the transaction;

- an increase due to the proceeds of assets or a decrease in liabilities.

5. The principle of the monetary measure.

Financial accounting of assets, liabilities, income, expenses of the company and business units is carried out by means of their assessment in a single hard currency. Usually the US dollar is chosen.

If the accounting is made on the basis of primary documents expressed in another currency, then the conversion into US dollars is made at the officially established or separately agreed exchange rate as of the date of the transaction.

The application of the principle of monetary measure does not mean the refusal to use natural measures when accounting for certain types of assets.

At the same time, the accounting of indicators in physical terms is carried out when reflecting business transactions with mandatory parallel taxation (multiplying the quantity by the price).

6. The principle of conservatism.

The application of this principle means that when it is possible to use two different methods of accounting for the same indicators, it is necessary to apply the method that presents the company's position in a less favorable light.

Profit is reflected only after its actual receipt, and loss - if possible.

Thus, the CFO is obliged to create provisions for any assets that appear to be more or less risky.

At the same time, assets should be accounted for at the lowest possible value, and liabilities at the highest.

7. The principle of completeness.

One of the main tasks of financial accounting is to obtain complete and reliable information about the property status and results of economic activity of a company or business unit.

The practical application of this principle is expressed in the mandatory inclusion in the financial statements of the necessary adjustments and explanations, if the standard forms of financial statements do not give a complete picture of the company's activities.

8. The principle of materiality.

The principle of materiality determines that information obtained as a result of financial accounting should be meaningful to the user.

The principle of materiality is expressed in the degree of significance of changes in estimates, in the correction of errors in the reports of previous periods, or in various ways of reflecting quantitative data.

These changes and corrections are considered material if they are large enough or important enough to influence decisions taken on the basis of the financial statements.

By general rule, any distortion of reporting data is considered insignificant if its relative value does not exceed 5% of the value of the corresponding indicator and 0.5% of the amount of assets.

9. The principle of rationality.

In accordance with the principle of rationality, the advantages and benefits derived from the information received must exceed the costs associated with obtaining it.

This principle complements the principle of materiality, in fact, establishing a second criterion, in accordance with which the need to correct accounting data is assessed.

10. The principle of relevance (relevance).

Information is relevant if it can have a practical impact on the degree of decision-making.

This means that the information should provide the ability to assess the company's performance and make its forecast.

Accordingly, financial information must be submitted in a timely manner (within a strictly specified time frame) and contain the required minimum of essential data for making a specific decision.

One of the components of this principle is feedback, that is, the ability, as a result of the analysis of financial accounting data, to assess the previously made investment decision.

11. The principle of reliability (credibility).

The reliability of the information received is one of the goals of financial accounting.

Its achievement is carried out through a continuous, systematic accounting of business transactions, as well as an alternative verification of the data obtained.

The need for an alternative verification means that any significant indicator of financial statements must either be verified by reconciliation with other accounting data (in particular, accounting), or determined independently of the main accounting system.

One of the important requirements of the principle of reliability is the consistency of financial accounting, expressed in accordance with the data analytical accounting synthetic accounting and reporting data.

12. The principle of priority of content over form.

Business transactions in financial accounting should be accounted for solely on the basis of their economic content and business conditions, regardless of the specific legal form in which they are clothed.

One of the expressions of this principle is the requirement of neutrality, that is, the release of financial data from any influence.

When preparing financial statements, it is necessary to be guided only by economic laws, its distortion is not allowed in order to influence the adoption of a specific management decision.

13. The principle of constancy (consistency).

The principle of constancy assumes the constancy of the application of accounting procedures (methods) for a certain period of time.

Any company is obliged to apply uniform accounting policies during the calendar year, to maintain a stable composition of reporting indicators.

Changes in accounting methods and the composition of reporting indicators can be made from the beginning of the next calendar year.

At the same time, it is important to comply with the requirement of comparability (comparability): the reporting data for the current period must be comparable with the data for the corresponding periods of the previous calendar years.

Accounting policy - features of the choice of key provisions

So, the CFO has decided on the principles of financial accounting. Further, the question arises about the accounting methods by which both the CFO and the entire company will be guided, that is, we are talking about the accounting policy of the company. The accounting policy of the company is formed by the CFO.

For each business unit, the CFO must establish a system of indicators for analytical accounting, synthetic accounting and financial reporting, as well as standard forms of documents, on the basis of which entries are made in the financial accounting system.

A change in the methodological approaches in terms of the valuation of assets and liabilities established in the accounting policy is allowed only when the style of doing business changes. Based on the principle of constancy, the accounting policy is formed for a long-term period.

The system of actual indicators consists of:

- financial balances (Table 2);

- profit and loss statements (Table 3);

- cash flow reports (replace this report with a report of actual budget indicators).

Since financial accounting is not regulated by legislative acts, there is no single chart of accounts. The financial director of the company himself forms the plan that he considers acceptable for himself and reflects it in the accounting policy.

Charts of accounts formed in enterprises reflect the influence of certain standards and financial principles, the essence of which in the article is formulated above.

Likewise, there are no uniform reporting forms in financial accounting that are mandatory for all companies. The balance sheet and income statement are standardized by the CFO and reflected again in the accounting policy ( approximate balance and the profit and loss statement - see table 2.3). Financial statements may differ in greater compactness, aggregation of indicators in comparison with accounting reporting forms, and that is why they are distinguished by greater visibility and, perhaps, greater analyticity.

An essential feature of financial accounting should be the preparation of consolidated statements. Consolidated reporting should not be confused, as is sometimes done, with summary reporting (mechanical aggregation of individual balances). The differences between them stem from the peculiarities of ownership of certain forms. Consolidation is due to the fact that very often speaking about business, we mean the activities of several law firms, that is, a group of companies linked by a single source of capital de facto and not always formalized de jure. Therefore, the CFO needs to formulate a consolidation procedure in the accounting policy and decide how transfer prices will be determined (the price at which legal entities within the same group of companies acquire material assets from each other), how the funds controlled by the parent company in the daughter society ( there can be many such societies-daughters and societies-granddaughters), are reflected in the balance sheet, as well as determine the cost of production within the group of companies, and much more.

table 2

Approximate financial balance

Balance At the beginning of the period At the end of the period ASSETS

1. SHORT-TERM ASSETS 1.1. Cash Funds in transit Funds in payments 1.2. Receivables Suppliers Buyers Accountable persons 1.3. Inventories of goods and materials Goods in stock Goods are shipping Raw materials and supplies Unfinished production 1.4. Fin. investments in third parties 2. LONG-TERM ASSETS 1.2.1 Fixed assets Real estate Equipment Intangible assets Construction in progress LIABILITIES

1. Accounts payable of counterparties Suppliers Buyers Accountable persons 2.Fin. liabilities to third parties Overdrafts 3. Capital and accumulated profit 4. Reserves 5. Unearned income

Note: Balance sheet account "Unearned income" is entered when choosing to recognize revenue from sales by payment.

Table 3

Sample profit and loss statement for a trade organization

CONSOLIDATED STATEMENT OF PROFIT AND LOSSES TOTAL Profit Center 1 Profit Center 2 Profit Center 3 Revenues from sales Sales volume in contract prices Gross profit from sales Trade margin Delivery overhead Cost of goods sold Related costs of product promotion Hospitality expenses Payroll of sellers Commissions for banking service Financial commissions Business trip Rent of retail sites of warehouses Gross profit Return on sales General and administrative expenses Automation costs Payroll of administrative staff Office space for rent Maintenance Profit before tax and payment of% on the loan % on loan Tax Profit from current activities Other profit (loss) From financial activities From investment activities Non-operating profit (loss) Exchange differences NET PROFIT Use of net profit

Moving from the chart of accounts and financial reporting to accounting procedures, it should be noted that the choice of the form of accounting in accounting policy is entirely within the competence of the CFO. The CFO can choose accounting procedures based on GAAP, that is, he does not seek to ensure that the turnover of accounts adequately reflects the real turnover in the legal and economic sense, because a double entry, from the point of view of our Western colleagues, is only a technique and nothing more. In this regard, the "red storno" method is not known abroad, which, with the help of reversal entries, makes it possible to reduce either erroneous or artificial turnovers. The features of the Western methodology in general include the widespread use of mixed transactions, when several accounts are debited and credited at the same time. This is also a very convenient solution, and the financial director can adopt these methods into service, although a Russian accountant cannot "compromise principles", because in this case, the correspondence between specific accounts is destroyed.

Another point that needs to be reflected in the accounting policy is the moment of recognition of sales proceeds. The moment of transfer of ownership of the considered object from the seller to the buyer is the main subject in the discussions of financiers. For some of our colleagues, the starting point is the concept of law, according to which implementation is the moment of transfer of ownership of a value. For others, the moment of sale is the moment of receipt of money from the buyer to the seller for the goods already shipped (the service provided), and it does not coincide with the moment of transfer of ownership. For others, this is the moment the money is received from the buyer to the seller, regardless of whether the transfer of ownership has taken place or not. Thus, according to one concept, profit occurs at the time of shipment of goods, according to other views - at the time of receipt of money. In the first case, there is profit, but there is no money to pay wages, pay off accounts payable and pay taxes. In any case, the decision of which accounting policy to choose (by shipment, by payment or by cash method) is made by the CFO independently. Any method has its pros and cons. So, when choosing a method for shipment, it is necessary to create and maintain reserves for doubtful debts (doubtful debts, based on the principle of conservatism, the CFO must recognize most of the receivables from buyers). Further, the circumstance - there is profit, but no money - forces the CFO to draw up a complex cash flow statement. When choosing the cash method, there is a risk that the advances received from buyers will be claimed back by them and the profit received will require adjustment. When choosing a payment method (the goods are shipped, the service is provided and the money is received in full), a system for comparing the shipped and paid goods is required, if the shipment and payment do not coincide in the same reporting period. The problem of matching is solved by the presence in the balance of two accounts: "Goods shipped and unpaid", "Unearned income".

After choosing the moment of recognition of proceeds from the sale, the CFO must select and register in the accounting policy the moment of recognition of the company's expenses. Based on the accrual principle, the income of the reporting period should be correlated with the expenses due to which these incomes were received. This is the most difficult one for practical application principle. It goes back to the significant interpretation of an asset given by E. Schmalenbach (1873-1955), who argued that an asset is a cost that should become income in the future. Hence, it becomes necessary to consider how the costs invested in assets are written off to the financial results of each reporting period. In connection with this expense, it is not the payment of money that can be recognized, but the emergence or exercise of rights to these payments (method of shipment). This method is labor intensive. Therefore, when recognizing expenses, the CFO can use the principle of materiality and write off part of the expenses using the simplest cash method, setting, for example, a 5% barrier.

Accounting for inventory is also part of the accounting policy. This is understandable. Indeed, depending on the assessment of inventories, the cost of goods sold is measured, which corresponds to the proceeds from the sale. At the same time, in the repertoire of the financier there are at least four options for assessing inventories: individual accounting, assessment at average prices, assessment at the price of the last (LIFO) or first (FIFO) batch of receipt. Which option should you choose? It is necessary to understand that if the inflation rate is high, and the company uses the LIFO method, then the cost of inventories (balances) of inventories will be underestimated, and the cost of sold values will be overestimated, and, therefore, the amount of profit will be underestimated. (It is no coincidence that the LIFO method is prohibited in the UK.) If the FIFO method is used in similar conditions, then the cost of inventory (residuals) of inventories will be overestimated, and the cost of goods sold will be underestimated, and, thus, the amount of profit will be exaggerated. At least four important conclusions follow from this:

- there is no direct connection between movement in value and in kind, for example LIFO means a latent increase in the value of the mass of commodities, while it is possible to reduce this mass in its physical terms;

- the LIFO and FIFO methods represent two extreme limits between which the true cost value lies;

- the essence of the LIFO and FIFO methods is not in assessing stocks (this is a side effect), but in comparing the current costs of goods sold during the reporting period with the proceeds received;

- the choice of the accounting method predetermines the financial result of the company.

Further, when formulating accounting policies, the CFO needs to classify costs. The assignment of the value of an object to a particular category depends on the importance attached to it by the owner. This is a kind of "Doolittle effect", a scavenger who demanded from Professor Higgins money relatively equal to the income of a millionaire. So, in one enterprise, an object can be attributed to fixed assets, and in another - exactly the same object can be immediately written off to the costs of this reporting period. The main criterion is the cost of the object, depending on this, it can be attributed either to fixed assets, or to low-value and wearing out items (MBE), or directly written off to the costs of the enterprise. In the accounting of some countries, for example, the USA, the intermediate group - the IBE, as a rule, is absent altogether and, accordingly, there is no regulatory account “Depreciation of low-value and fast-wearing items”. That is, the CFO can follow the example of our Western colleagues and thereby facilitate the accounting of costs by introducing into the accounting policy the possibility of referring certain objects either to fixed assets accounts or to cost accounts.

Since financial accounting consists of two interrelated parts: accounting for planned indicators and accounting for actual data in the accounting policy, the budgetary policy of the company is additionally prescribed. The main task of the Company's budgeting is to obtain and summarize economic information about the Company's activities for making management decisions for the long term.

Accounting for planned indicators is carried out in order to obtain and generalize economic information about the state and main characteristics of the Company's turnover, sources of its formation, as well as the movement of financial flows for the planned period.

Planned periods in budgetary policy can be set equal to one year or 6 months with a breakdown by month.

Actual data are taken into account to obtain information on the performance of planned indicators, analyze the causes of deviations that arise and adjust the planned indicators for subsequent periods.

Budget data can be used to analyze the effectiveness of planned and implemented commercial transactions, and to draw up investment plans for the Company.

It is advisable to build a system of planned and actual indicators from:

- long-term financial plans (budgets) and reports on their execution, which determine the directions of changes in the company's turnover and expenses (Table 5) during the planning period, namely the structure of turnover (Table 6), the structure of expenses by core activity (see Table 4 ), structure investment projects and financial investments.

Table 4

Budget structure of company expenses

Financial accounting Is a system for collecting and processing accounting information required for the preparation of financial statements. Financial accounting includes information on the accounting of balance sheet accounts: fixed assets - intangible assets, financial investments, inventories, cash, and is used not only within the enterprise, but also by external users. Financial accounting is regulated by regulations.

Purpose of financial accounting- formation of information about the activities of the organization as a whole: income and expenses, the state of funds, accounts receivable and payable, payments to the budget and off-budget funds, about financial investments, financial results, etc. Financial accounting subject- economic activity of the enterprise. Objects are property (economic assets, assets of the enterprise), capital and liabilities of the enterprise (sources of formation of property), as well as business transactions that cause changes in property and sources of its formation.

Financial accounting principles. 1. Principle of monetary expression - accounting operates with data that have monetary value.2. The principle of the company's autonomy - the company's accounting accounts are independent from the accounting accounts of its owners and employees. 3. The principle of continuity - the enterprise works indefinitely. 4. The principle of materiality is not to waste time on taking into account insignificant facts. 5. The principle of conservatism - when choosing, the accountant chooses the amount that is less optimistic. 6. The principle of constancy - during one reporting period, you need to use one form and method of accounting. 7. The principle of the national currency - in accounting, the method of evaluating funds in a constant currency is applied throughout the entire reporting period. 8. Cost principle - funds are valued at cost at the time of acquisition, not market value. 9. The principle of implementation - enterprises take into account their income at the time of shipment of the goods, and not at the time of payment. 10. Correspondence principle - profit - revenue of the reporting period - costs of this period 11. The principle of duality is the principle of balance, when accounting information is considered according to the composition of funds and the sources of their formation: the totality of all funds (asset) is equal to the totality of sources (liability); the principle of double entry: a business transaction that changes the composition of funds and sources of formation does not violate the principle of balance. Financial accounting tasks.

1. Formation of complete, reliable information about the activities of the enterprise, required by users. 2. Providing users with information to monitor compliance with legislation, the feasibility of business operations, the availability and movement of property and obligations, the use of material, labor, financial resources in accordance with the approved standards. 3. Prevention of negative business results.

4. Identification of internal reserves to ensure the financial stability of the enterprise. Accounting and financial reporting are based on the following basic principles: discretion- application of valuation methods in accounting, which should prevent underestimation of liabilities and expenses and overestimation of assets and income of the enterprise; full coverage- financial statements should contain all information about the actual and potential consequences of business transactions and events that can influence the decisions that are made on its basis; autonomy- each enterprise is considered as a legal entity, separate from its owners, and therefore the personal property and obligations of the owners should not be reflected in the financial statements of the enterprise; subsequence- constant (from year to year) application of the chosen accounting policy by the enterprise. A change in accounting policy is possible only in cases stipulated by national regulations (standards) of accounting, and must be justified and disclosed in the financial statements; continuity- the assessment of the assets and liabilities of the enterprise is carried out on the assumption that its activities will continue further; accrual and correspondence of income and expenses- to determine the financial result of the reporting period, it is necessary to compare the income of the reporting period with the expenses that were incurred to obtain these income. In this case, income and expenses are displayed in accounting and financial statements at the time of their occurrence, regardless of the date of receipt or payment of funds; prevalence of essence over form- transactions are accounted for in accordance with their essence, and not only on the basis of their legal form; historical (actual) cost- the priority is the assessment of the assets of the enterprise, based on the costs of their production and acquisition; single monetary measure- measurement and generalization of all business transactions of the enterprise in its financial statements is carried out in a single monetary unit; periodicity- the ability to distribute the activities of the enterprise for certain periods of time for the purpose of drawing up financial statements.

An important place in financial accounting is given to the application of fundamental principles, without which it would be impossible for users to compare information about the activities of various organizations.

The basic principles of financial accounting are:

Monetary measurement, that is, all funds and sources of their formation, business transactions and results of activities should be reflected in financial accounting in monetary terms;

Mandatory documentation, that is, all business transactions and results of activities must be formalized with the appropriate financial accounting documents. Documentation of transactions provides financial accounting with the necessary information about economic means and processes and gives its indicators legal force and reliability;

Bilateral, i.e. all funds and sources of their formation, business operations and results of activities should be reflected in financial accounting according to the channels of receipt and the sources of their formation, which implies the opening of separate accounting accounts to reflect the channels of receipt of funds and their placement with equality in both accounting accounts. This is how the requirement for the mandatory performance of double entry arose;

Autonomy (property isolation) implies that the property of an organization should be strictly delimited and separated from the property of its co-owners, employees and other organizations, i.e. the organization is considered as a legally independent and independent structure;

An operating organization assumes that any established organization must function for an indefinite period, i.e. be permanent. The continuing activity of the organization does not imply an intention to reduce production;

Cost accounting, i.e. the assessment of all funds and sources of their formation, business operations and the results of the organization's activities should be made on the basis of their economic content and the rules provided for by the current legislation and relevant regulations;

The accounting period, i.e. according to the principle of the operating organization, the duration of its work is not limited, which means that it will not be possible to determine the result of the activity indefinitely for a long time, but the management, founders and other interested users periodically need to know how things are going in the organization. This need is realized using the accounting period principle. In accordance with the current legislation, the accounting period is a calendar year, and the interim accounting period is a quarter, a month;

Conservatism, implies caution and prudence in relation to the depreciation of assets, doubtful debts of customers, significantly affecting the results of both the reporting and future periods, making a profit or making an expense involves the organization's willingness to recognize expense rather than income;

Completeness, provides for the reflection of all economic phenomena and processes, disclosure of the current state and results of the organization's activities in full;

Clarity, provides for the reflection of information in financial accounting clearly and understandably for any user;

Confidentiality, assumes that the content of internal accounting information is a commercial secret of the organization, for disclosure and damage to its interests there is a liability established by law;

Objectivity, that is, all business transactions must be reflected in financial accounting, be registered throughout all stages of accounting, be confirmed by supporting documents on the basis of which accounting is maintained.

Question 5. Organizational and legal characteristics of enterprises and their impact on the organization of financial accounting

In modern conditions, organizations of various forms of ownership function in Russia: federal, municipal, joint-stock, cooperative, private, each of which is a legal entity, except for private ones without the formation of a legal entity. Legal entities that are commercial organizations, can be created in the form of joint stock companies (open, closed), unitary enterprises (state (federal) and municipal), business partnerships (full, on faith), production cooperatives.

The organizational and legal form of the organization affects the formation, and subsequently the organization of accounting for equity capital, which can act in the form of authorized capital, contributed capital, authorized fund, share fund.

The authorized capital is created in joint stock companies open and closed, limited and additional liability companies in the form of contributions (shares) of founders (participants) in monetary terms.

The pooled capital is created in general and limited partnerships in the form of contributions (shares) of participants in monetary terms.

The statutory fund is created in unitary enterprises by endowing them with state (federal, municipal) authorities of fixed and circulating assets in monetary terms.

A mutual fund is created in production cooperatives by contributions of members of the cooperative in monetary terms.

Any of the listed organizations can be classified as large, medium, small, which in turn affects the organization of accounting.

The specifics of accounting for individual business operations for the formation and movement of capital will be considered in the subsequent topics of the discipline "Financial accounting".

Technological and organizational features of production affect the accounting of the organization's assets, business transactions and financial performance.

For the implementation of these processes, a certain availability of economic assets is required (fixed and current assets). Household assets of the organization include - fixed assets, intangible assets, investments in non-current assets, financial investments, production stocks, settlements with debtors, cash, other assets. Assessment of assets in financial accounting is carried out in accordance with the requirements regulatory framework: Regulation on accounting and reporting in Russian Federation... Approved by order of the Ministry of Finance of the Russian Federation of July 29, 1998 No. 34n, PBU, etc.

The formation of economic assets is carried out at the expense of our own and external sources:

a) own sources (authorized, own, reserve and additional capital, retained earnings, other sources of own funds);

b) attracted sources (long-term bank loans and borrowed funds, short-term bank loans and borrowed funds, settlements with creditors, other short-term liabilities).

In the course of its activity, the organization carries out a number of business operations related to the formation of the financial result. The assessment of business transactions is carried out in accordance with the criteria enshrined in the accounting policy of the organization.

Financial accounting data is used internally by managers of various levels to control the movement of financial flows in the receipt and expenditure of non-cash and cash and external indicators. Financial accounting covers a significant part of accounting, accumulates information about the property, liabilities and business processes of the organization in accordance with the requirements of accounting regulations.

Consequently, financial accounting collects economic information, which provides accounting and registration of property and sources of their formation, business transactions, as well as the preparation of financial statements.