The calculation of net assets according to the balance sheet is carried out in accordance with the requirements of Order No. 84n dated August 28, 2014. JSCs, LLCs, municipal / state unitary enterprises, cooperatives (production and housing) and economic partnerships must apply the procedure. Let us consider in detail what the term net assets means, what significance this indicator has for assessing the financial condition of a company, and what algorithm is used to calculate it.

What determines the size of net assets in the balance sheet

Net assets (NA) include those funds that will remain in the ownership of the enterprise after the repayment of all current liabilities. Defined as the difference between the value of assets (inventory, intangible assets, cash and investments, etc.) and debts (to contractors, personnel, budget and off-budget funds, banks, etc.) with the necessary adjustments.

Calculation of the value of net assets on the balance sheet is carried out based on the results of the reporting period (calendar year) in order to obtain reliable information about the financial condition of the company, analyze and plan further operating principles, pay dividends received or a valid business valuation in connection with a partial / full sale.

When a net asset determination is required:

- During the completion of the annual accounts.

- When leaving the member's company.

- At the request of interested parties - creditors, investors, owners.

- In the case of an increase in the amount of the authorized capital at the expense of property contributions.

- When issuing dividends.

Conclusion - NA is the net assets of the company, formed at the expense of own capital and not burdened with any obligations.

Net assets - formula

To determine the indicator, the calculation includes assets, except for the debt of the organization's participants / founders, and liabilities from the liability section, with the exception of those deferred income that arose as a result of receiving state aid or donated property.

General calculation formula:

HA = (Outside current assets+ Current assets – Debt of the founders – Debt of shareholders in connection with the repurchase of shares) – (Long-term liabilities + Short-term liabilities – Deferred income)

NA \u003d (p. 1600 - ZU) - (p. 1400 + p. 1500 - DBP)

Note! The value of net assets (the formula for the balance sheet is given above) requires, when calculating, to exclude objects accepted for off-balance accounting under the accounts of the answer storage, BSO, reserve funds and etc.

Net assets - formula for calculating the balance sheet 2016

The calculation must be made in an understandable form according to a self-developed form, which is approved by the head. It is allowed to use the previously valid document for determining the NA (Order No. 10n of the Ministry of Finance). The specified form contains all the required fields to fill out.

How to Calculate Net Assets on a Balance Sheet - Short Formula

The value of net assets on the balance sheet - the 2016 formula can be determined by another, new method, which is contained in Order No. 84n:

NA = Equity/reserves (line 1300) + DBP (line 1530) – Debts of founders

Analysis and control

The size of Net Assets (NA) is one of the main economic and investment indicators work of any enterprise. The success, stability and reliability of the business is characterized by positive values. A negative value shows the unprofitability of the company, possible insolvency in the near future, probable risks of bankruptcy.

According to the results of settlement actions in dynamics, the value of net assets is estimated, which should not be less than the value of the authorized capital (UK) of the company. If the decrease nevertheless occurred, according to the legislation of the Russian Federation, the enterprise is obliged to reduce its Criminal Code and officially register the changes made in the Unified Register (law No. 14-FZ, article 20, paragraph 3). The exception is newly created organizations operating for the first year. If the amount of net assets is less than the size of the UK, the enterprise may be forcibly liquidated by decision of the Federal Tax Service.

In addition, there is a relationship between the value of NA and the payment of due dividends to participants/shareholders. If, after the accrual of income/dividends, the value of net assets drops to a critical level, it is required to reduce the amount of accruals to the founders or completely cancel the operation until the specified ratios are reached. You can increase the NA by revaluing the property resources of the enterprise (PBU 6/01), receiving property assistance from the founders of the company, inventorying obligations in terms of terms limitation period and other practical methods.

Net asset value on the balance sheet - line

The financial statements of the organization contain all the indicators required for mathematical calculations, expressed in monetary terms. In this case, data are taken at the end of the reporting period. When it is necessary to determine the value for another date, interim reports should be prepared at the end of the quarter / month or half year.

Attention! The amount of net assets is also displayed on line 3600 of form 3 (Statement of changes in equity). If a negative value is received, the exponent is enclosed in parentheses.

A). The standard establishes the limiting ratio between short-term assets (short-term receivables on loans provided by the cooperative) repaid within twelve months after the current date and the amount of the cooperative's liabilities (on the personal savings of shareholders transferred to the cooperative, their loans attracted from shareholders and persons who are not shareholders of the cooperative) due within the next twelve months.

The standard is calculated by the formula:

FN8 \u003d SDT / LMS * 100%

- SMT - sum monetary claims credit cooperative, the maturity of which is within 12 months after the reporting date.

- LMS – the amount of monetary liabilities of a credit cooperative, which mature within 12 months after the reporting date.

B). The minimum allowable value of the FN8 norm for credit cooperatives, the period of activity of which is 180 days or more from the date of their creation, is set at the rate of:

- 30 percent - until June 30, 2016 inclusive;

- 40 percent - from July 1, 2016;

- 60 percent - from January 1, 2017;

- 75 percent - from January 1, 2018.

For credit cooperatives, the period of activity of which is less than 180 days from the date of their creation, the minimum allowable value of the FN8 financial standard is set at 50%.

5.2.2. The economic meaning of the standard

In terms of its economic meaning, the FN8 financial ratio is similar to the general liquidity indicator, which regulates the risk of losing liquidity over the next twelve months. The ratio characterizes the ability of the cooperative to meet its short-term obligations at the expense of current assets. The current assets of a credit cooperative are represented by receivables on loans provided to shareholders and cooperatives of the second level, and the bulk of liabilities are formed from personal savings transferred by shareholders and loans attracted from shareholders - legal entities and persons who are not shareholders of the cooperative. Therefore, the standard actually regulates the relationship between funds due to be received and obligations to be fulfilled within the next twelve months.

The financial standard is being implemented within two years with a gradual tightening of the share of short-term assets in liabilities. If in the first half of 2016 it is assumed that only 30% of the obligations on the funds attracted by the cooperative, the maturity of which falls on the next year, will be fulfilled at the expense of loans returned by shareholders, then by January 1, 2018 this share should already be 75%. Thus, the level of liquidity of the cooperative in relation to obligations on attracted funds will consistently increase. This does not mean that the structure of receivables and liabilities on borrowed funds will shift to the short-term segment. Along with short- and medium-term lending, the cooperative can also develop the practice of long-term lending, while at the same time motivating shareholders to transfer savings and loans for the long term.

5.2.3. Initial data and the procedure for calculating the FN8 standard.

The amount of receivables on loans provided by the cooperative, repaid within 12 months after the reporting date, the funds at the disposal of the cooperative is determined by the indicators of the accounts:

The amount of liabilities on attracted funds, repaid within 12 months after the reporting date, is determined by the indicators of the accounts:

- 66.1 "Short-term loans";

- 66.3 "Short-term loans".

Not all assets can be repaid in a timely manner, some of them are formed from bad debts in the repayment of which there were delays. In accordance with the Directive of the Bank of Russia dated July 14, 2014 N 3322-U, the cooperative forms a reserve for such debts for possible losses on loans. In order to adequately assess the liquidity resources of the Cooperative, it is advisable to take into account, along with obligations maturing within the next 12 months, the amount of the reserve formed by the cooperative for possible losses on loans in successively increased shares, as provided for in paragraph 9 of Directive No. 3322-U.

The amount of the reserve formed by the cooperative for possible losses on loans is reflected in account 59 “Reserves for depreciation of financial investments”.

The ratio between the amount of monetary claims and liabilities of a credit cooperative with a maturity within the next 12 months is calculated using the following formula:

FN8 = ∑(score 58.3; score 58.2)/∑(score 66.1; score 66.2; score 63(score 59)) * 100% ≥30%;40%;60%;75%;50%

To assess the FN8 standard in the system of accounts accounting in the NFO introduced from 01/01/2018, along with the previously described accounts, the following accounts can be used:

- Account 48501 “Loans issued legal entities»;

- Account 48510 "Provisions for impairment on loans issued to legal entities";

- Account 48601 "Loans issued to legal entities";

- Account 48610 "Provisions for impairment on loans issued to legal entities";

- Account 48701 “Microloans (including targeted microloans) issued to legal entities”;

- Account 48710 "Provisions for impairment on loans issued to legal entities";

- Account 48801 “Microloans (including targeted microloans) issued to individuals”;

- Account 48810 "Provisions for impairment on loans issued to individuals";

- Account 49301 "Loans issued to individual entrepreneurs";

- Account 49310 "Provisions for impairment on loans issued to individual entrepreneurs";

- Account 49401 “Microloans (including targeted microloans) issued to individual entrepreneurs”;

- Account 49410 “Impairment provisions for microloans (including targeted microloans) issued to individual entrepreneurs”;

- Account 49501 "Loans issued to a credit consumer cooperative of the second level";

- Account 49510 “Provisions for impairment on loans issued to a credit consumer cooperative of the second level”;

- Account 42316 “Funds raised individuals»;

- Account 43708 "Attracted funds from non-state financial organizations";

- Account 43808 "Attracted funds from non-governmental commercial organizations";

- Account 43908 "Attracted funds from non-governmental non-profit organizations";

- Account 50104 "Debt securities Russian Federation»;

- Account 50105 "Debt securities of constituent entities of the Russian Federation and local authorities".

5.2.4. Reporting indicators in the format established by the instructions of the Bank of Russia No. 3357-U, which control compliance with the FN8 standard, which regulates the ratio between short-term claims and short-term liabilities

To assess compliance with the FN8 standard, the following reporting indicators are used:

From the summary form "Report on activities":

- Page 1.1.1 "Accounts receivable for loans to shareholders of individuals (which are expected to mature within one year after the reporting date)".

- Page 1.1.2. “Accounts receivable for loans granted to shareholders of legal entities (the maturity of which is expected within one year after the reporting date)”.

- Page 1.1.3. "Accounts receivable from loans to second-tier credit cooperatives (which are expected to mature within one year after the reporting date)".

- Page 3.1.1.1. "Attracted funds from shareholders - individuals for a period of up to one year."

- Page 3.1.2.1. "Attracted funds from shareholders - individuals for a period of up to one year."

- Page 3.1.3. "Funds raised from persons who are not shareholders of the cooperative."

The standard is calculated from the following ratio of indicators of the consolidated reporting form "Report on activities":

FN8 = ∑ reporting activities p.1.1.1; p.1.1.2; p.1.1.3/∑ reporting activities p.3.1.1.1; p.3.1.2.2; p.3.1.3 * 100%

When generating reports, the cooperative can independently verify compliance with the standard on the "Standards" sheet. In the event that the FN8 standard is not observed in the parameters set for the corresponding date of the transition period, the “Error” code will be displayed in the column “Checking compliance with the FN8 standard”. If the ratio of short-term assets and liabilities is maintained at a normalized level, the code "norm" is displayed.

Consider the concept, calculation formula and economic sense net assets of the company.

Net assets

Net assets (EnglishNetassets) - reflect the real value of the property of the enterprise. Net assets are calculated by joint-stock companies, limited liability companies, state-owned enterprises and supervisory authorities. The change in net assets allows you to evaluate financial condition enterprises, solvency and level of risk of bankruptcy. The methodology for assessing net assets is regulated by legislative acts and serves as a tool for diagnosing the risk of bankruptcy of companies.

Net asset value is it? Calculation formula

The composition of assets includes non-current and current assets, except for the debt of the founders on contributions to the authorized capital and the cost of repurchasing own shares. Liabilities include short-term and long-term liabilities, excluding deferred income. The calculation formula is as follows:

NA - the value of the net assets of the enterprise;

A1 - non-current assets of the enterprise;

A2 - current assets;

ZU - debts of the founders on contributions to the authorized capital;

ZVA - the cost of repurchasing own shares;

P2 - long-term liabilities

P3 - short-term liabilities;

DBP - deferred income.

An example of calculating the net asset value of a business in Excel

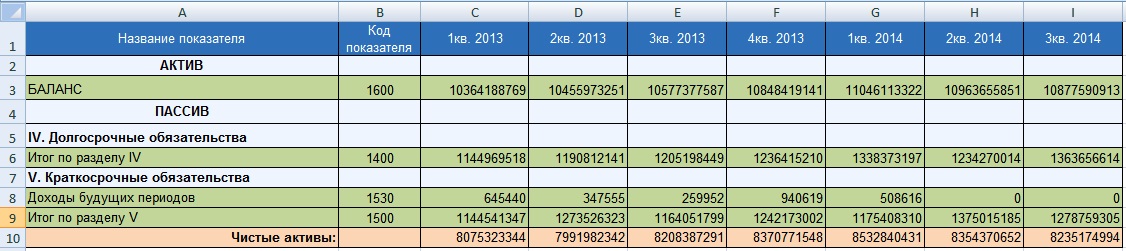

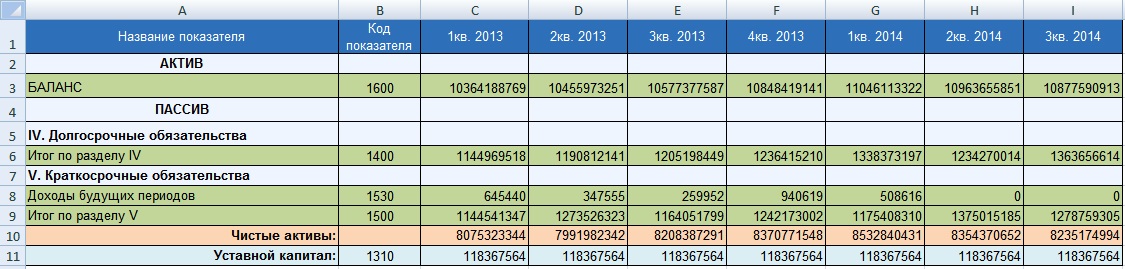

Consider an example of calculating the value of net assets for the organization OAO Gazprom. To assess the value of net assets, it is necessary to obtain financial statements from the official website of the company. The figure below highlights the balance sheet lines necessary to assess the value of net assets, the data are presented for the period from Q1 2013 to Q3 2014 (as a rule, net assets are assessed annually). The formula for calculating net assets in Excel is as follows:

Net assets=C3-(C6+C9-C8)

Video lesson: “Calculating the value of net assets”

Analysis of net assets is carried out in the following tasks:

- Assessment of the financial condition and solvency of the company (see → “ “).

- Comparison of net assets with authorized capital.

Solvency assessment

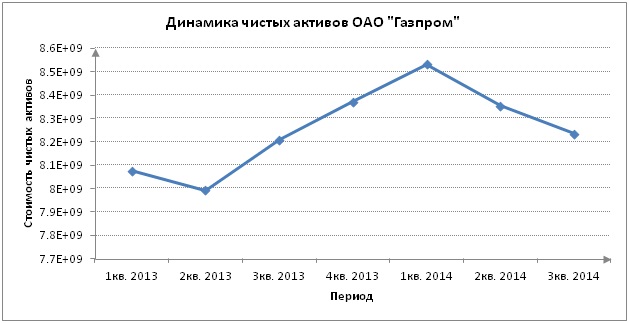

Solvency is the ability of an enterprise to pay for its obligations in a timely manner and in full. To assess solvency, firstly, a comparison of the value of net assets with the size of the authorized capital is carried out, and, secondly, an assessment of the trend of change. The figure below shows the dynamics of changes in net assets by quarter.

Analysis of the dynamics of changes in net assets

Solvency and creditworthiness should be separated, so creditworthiness shows the ability of an enterprise to pay off its obligations using the most liquid types of assets (see →). Whereas solvency reflects the ability to repay debts both with the help of the most liquid assets and those that are slowly sold: machine tools, equipment, buildings, etc. As a result, this may affect the sustainability of the long-term development of the entire enterprise as a whole.

Based on the analysis of the nature of the change in net assets, an assessment of the level of financial condition is made. The table below shows the relationship between the trend in net assets and the level of financial condition.

Comparison of net assets with authorized capital

In addition to the dynamic assessment, the value of net assets for an OJSC is compared with the size of the authorized capital. This allows you to assess the risk of bankruptcy of the enterprise (see → ). This comparison criterion is defined in the law of the Civil Code of the Russian Federation ( paragraph 4 of Art. 99 of the Civil Code of the Russian Federation; paragraph 4 of Art. 35 of the Law on joint-stock companies ). Failure to comply with this ratio will lead to the liquidation of the enterprise in court. The figure below shows the ratio of net assets and authorized capital. OAO Gazprom's net assets exceed its authorized capital, which eliminates the risk of the company going bankrupt in court.

Net assets and net income

Net assets are also analyzed with other economic and financial indicators of the organization. So the growth dynamics of net assets is compared with the dynamics of changes in sales proceeds and . Sales revenue is an indicator reflecting the effectiveness of the sales and production systems of the enterprise. Net profit is the most important indicator of the profitability of a business; it is at the expense of it that the assets of the enterprise are primarily financed. As can be seen from the figure below, net profit decreased in 2014, which in turn affected the value of net assets and financial condition.

Analysis of the growth rate of net assets and international credit rating

V scientific work Zhdanova I.Yu. shows the existence of a close relationship between the rate of change in the net assets of the enterprise and the value of the international credit rating of such agencies as Moody’s, S&P and Fitch. The slowdown in the economic growth rate of net assets leads to a decrease in the credit rating. This in turn leads to a decrease investment attractiveness enterprises for strategic investors.

Summary

The value of net assets is an important indicator of the value of the real property of the enterprise. Analysis of the dynamics of this indicator allows you to assess the financial condition and solvency. The value of net assets is used in regulated normative documents and legislative acts to diagnose the risk of bankruptcy of companies. A decrease in the growth rate of the company's net assets leads to a decrease not only financial stability but also the level of investment attractiveness. Subscribe to the newsletter on express methods of financial analysis of the enterprise.

Financial instruments are contractual relations between two legal (individual) persons, as a result of which one has a financial asset, and the other has financial liabilities or equity instruments associated with capital.

Contractual relations can be both bilateral and multilateral. It is important that they have clear mandatory economic consequences, from which the parties cannot evade by virtue of the current legislation. As we can see, the concept financial instrument defined in terms of other concepts such as financial assets and financial liabilities. Without knowing their essence, it is impossible to understand the characteristics of financial instruments.

Financial instruments include accounts receivable and accounts payable v traditional forms and in the form of bills, bonds, other debt securities, equity securities, as well as derivative forms, various financial options, futures and forward contracts, interest and currency swaps*, regardless of whether they are reflected in the balance sheet or off the balance sheet of the organization. Avali on bills of exchange, other guarantees for the fulfillment of obligations by other persons are classified as contingent financial instruments. Derivatives and contingent financial instruments give rise to the transfer by one party to another of certain financial risks determined by the underlying financial instrument, although the underlying financial instrument itself is not transferred to the issuer of derivative financial instruments.

IAS-32 and IAS-39 also apply to contracts to buy and sell non-financial assets because they are settled through cash consideration or the transfer of other financial instruments.

* Swap - a transaction for the purchase (sale) of foreign currency with its immediate transfer and with the simultaneous registration of the purchase (sale) of the same currency for a period at the rate determined during the transaction.

The decisive factor determining the recognition of financial instruments is not the legal form, but the economic content of such an instrument.

Financial assets are cash or contractual rights to demand the payment of funds, or the transfer of profitable financial instruments from another company, or the mutual exchange of financial instruments on favorable terms for themselves. Financial assets also include equity instruments of other companies. In all cases, the benefit from financial assets lies in their exchange for money or other profitable financial instruments.

Financial assets do not include:

debt on advances issued to suppliers of material assets, as well as in payment for work and services to be performed. They do not give rise to rights to receive cash and cannot be exchanged for other financial assets;

contractual rights, such as futures contracts that are expected to be satisfied in goods or services but not in financial assets;

non-contractual assets arising from legislation, such as tax debtors;

tangible and intangible assets, the possession of which does not give rise to a valid right to receive cash or other financial assets, although the right to receive them may arise when assets are sold or in other similar situations.

Financial assets

Cash Contractual rights to demand money and other financial assets Contractual rights to a favorable exchange of financial instruments Equity instruments of other companies

The features by which financial assets are classified are shown in the diagram below.

Financial assets are called monetary if, under the terms of the contract, they provide for the receipt of fixed or easily identifiable amounts of money.

Refers to financial assets

Cash in cash, banks, payment cards, checks, letters of credit

Fixed assets, inventories, intangible assets

Contractual receivables for goods and services payable in cash and other financial assets of counterparties

Promissory notes, bonds, other debt securities, except for those on which the debt is repaid in tangible and intangible assets, as well as services

Shares and other equity instruments of other companies and organizations

Accounts receivable for advances paid, short-term leases, commodity futures contracts

Debtors under options, for the acquisition of equity instruments of other companies, currency swaps, warrants

Accounts receivable under loan and financed lease agreements

Financial guarantees and other conditional rights

Debtors for tax and other obligatory non-contractual payments

| Does not apply to financial assets |

Financial liabilities arise from contractual relationships and require the payment of cash or the transfer of other financial assets to other companies and organizations.

Financial liabilities also include an upcoming exchange of financial instruments under an agreement with another company on potentially unfavorable terms. When classifying financial liabilities, one should keep in mind the limitations associated with the fact that liabilities that do not involve the transfer of financial assets upon their redemption are not financial instruments. On the other hand, share options or other obligations to transfer one's own equity financial instruments to another company are not financial liabilities. They are accounted for as equity financial instruments.

Financial liabilities include accounts payable to suppliers and contractors, under loan and credit agreements, including debt on issued and accepted promissory notes, placed bonds, issued guarantees, avals and other contingent liabilities. Financial liabilities include the tenant's debt under a finance lease, as opposed to an operating lease, which involves the return of the leased property in kind.

Financial obligations

Contractual obligation to transfer financial assets to another entity

Contractual obligation for an unfavorable exchange of financial instruments

Deferred income received against future reporting periods, guarantee obligations for goods, works, services, reserves formed to regulate costs for reporting periods are not financial liabilities, since they do not imply their exchange for cash and other financial assets. Any contractual obligations that do not involve the transfer of money or other financial assets to the other party, by definition, cannot be classified as financial liabilities. For example, obligations under commodity futures contracts must be settled by delivery of contingent goods or services that are not financial assets. It is impossible to consider as financial obligations those that arise not in accordance with contracts and transactions, due to other circumstances. For example, tax liabilities arising from legislation do not qualify as financial liabilities.

Financial liabilities should not be confused with equity financial instruments, which are not expected to be settled in cash or other financial assets. For example, stock options are satisfied by transferring a certain number of shares to their owners. These options are equity instruments and not financial liabilities.

An equity instrument is a contract that grants the right to a certain share of the capital of an entity, which is expressed in terms of the value of its assets, not burdened with liabilities. The value of the capital of an organization is always equal to the value of its assets minus the sum of all liabilities of this organization. Financial liabilities differ from equity instruments in that interest, dividends, losses and gains on financial liabilities are accounted for in the profit and loss account, while income on equity instruments allocated to their owners is debited from equity. Equity instruments include ordinary shares and issuer options to issue ordinary shares. They do not give rise to the obligation of the issuer to pay money or transfer other financial assets to their owners. The payment of dividends is the distribution of a part of the assets that make up the capital of the organization; these distributions and payments are not binding on the issuer. The issuer's financial obligations arise only after the decision to pay dividends and only for the amount due to be paid in cash or other financial assets. Dividends that are not payable, such as those refinanced into newly issued shares, cannot be classified as a financial liability.

Own shares purchased from shareholders reduce the equity of the company. The amount of the deduction is reflected in the balance sheet or in a special note to it. Any transactions with equity instruments and their results - issue, redemption, new sale, redemption - cannot be reflected in profit and loss accounts.

Equity-based payments are based on transactions in which an entity receives goods and services as a consideration for its equity instruments, or settlements for which cash is paid on an equity-based basis.

Their accounting treatment is set out in IFRS-2 “Payments in Equity Instruments”, which considers this special case taking into account IAS-32 and IAS-39.

An entity is required to recognize goods and services at their fair value when they are received, while recognizing increases in equity. If the transaction involves cash payments in lieu of equity instruments, then the entity is required to recognize a corresponding liability on that basis. If the goods and services received cannot be recognized as assets, their cost is recognized as an expense. The goods and services received under such transactions are measured indirectly at the fair value of the equity instruments granted.

Equity payments are more often made for the services of employees or in connection with the conditions of their employment, so these issues are discussed in detail in § 13.7 of this textbook.

Preferred shares are classified as equity instruments only in cases where the issuer does not assume the obligation to buy them back (redemption) in certain period or at the request of the owner within a certain period. Otherwise, when the issuer is obliged to transfer any financial assets, including cash, to the owner of preferred shares within a specified period, and at the same time terminate the contractual relationship with these preferred shares, they are classified as financial liabilities of the issuing organization.

A minority interest in an entity's equity that appears on its consolidated balance sheet is neither a financial liability nor an equity instrument. Subsidiaries whose balance sheets are included in the entity's consolidated balance sheet include equity instruments that are redeemed on consolidation if owned by the parent company or remain on the consolidated balance sheet if owned by other companies. The minority interest characterizes the amount of equity instruments of its subsidiaries not owned by the parent company.

The attributes by which financial liabilities and equity instruments are classified are shown in the chart below.

Compound financial instruments consist of two elements: a financial liability and an equity instrument. For example, bonds convertible into ordinary shares of the issuer essentially consist of a financial obligation to redeem the bond and an option (equity instrument) that gives its holder the right to receive ordinary shares that the issuer is obliged to issue within a specified period. Two contractual agreements coexist in one document. These relations could be formalized by two contracts, but they are contained in one. Therefore, the standard requires separate reporting in the balance sheet of amounts characterizing a financial liability and a separate equity instrument, despite the fact that they originated and exist as a single financial instrument. The primary classification of the elements of a complex financial instrument is retained regardless of possible changes in future circumstances and the intentions of its holders and issuers.

Relating to financial liabilities

Relates to equity instruments

Trade accounts payable Promissory notes and bonds payable in financial assets

Accounts payable on advances received for goods, works and services

Accounts payable under loan agreements and financed leases

Deferred income and warranties on goods and services

Accounts payable for shares of the company issued and transferred to buyers

Accounts payable on bonds and bills subject to redemption at a certain date or within a certain period

Obligations for taxes and other non-contractual payments

Forward and futures liabilities maturing non-financial assets

Contingent liabilities under guarantees and other bases contingent on any future events

Ordinary shares, options and warrants for the purchase (sale) of shares

Preferred shares subject to mandatory redemption

Preferred shares not subject to mandatory redemption

Related to other liabilities

Complex financial instruments may also arise for non-financial liabilities. So, for example, bonds can be issued that are redeemed by non-financial assets (oil, grain, automobile), simultaneously giving the right to convert them into ordinary shares of the issuer. In the balance sheets of issuers, such complex instruments should also be classified into liabilities and equity.

Derivatives are defined by three main features. These are financial instruments: the value of which changes under the influence of interest

rates, securities rates, exchange rates and commodity prices, as well as as a result of fluctuations in price or credit indices, credit rating or other underlying variables;

acquired on the terms of small financial investments compared to other financial instruments that also respond to changes in market conditions;

which are expected to be calculated in the future. A derivative financial instrument has a conditional

an amount that characterizes the quantitative content of this instrument, for example, the amount of currency, the number of shares, weight, volume or other commodity characteristic, etc. But the investor, as well as the person who issued this instrument, are not required to invest (or receive) the designated amount at the time of the conclusion of the contract. A derivative financial instrument may contain a notional amount payable on the occurrence of a future specific event, and the amount to be paid does not depend on that specified in the financial instrument. The conditional amount may not be indicated at all.

Typical examples of derivative financial instruments are futures, forwards, options, swaps, "standard" forward contracts, etc.

An embedded derivative is an element of a complex financial instrument that consists of a derivative financial component and a host contract; the cash flows arising from each of them change in a similar way, in accordance with the specified rate of interest, exchange rate or other indicators due to market conditions.

An embedded derivative must be accounted for separately from the host financial instrument (host contract) provided that:

economic characteristics and the risks of the embedded financial instrument are not associated with the same characteristics and risks of the underlying financial instrument;

a separate instrument and an embedded derivative financial instrument with the same terms and conditions meet the definition of derivative financial instruments;

such a complex financial instrument cannot be measured at fair value and changes in value should not be recognized in net income (loss).

Embedded derivatives include: put and call options on equity financial instruments that are not closely related to the equity instrument; options to sell or purchase debt instruments at a significant discount or premium that are not closely related to the debt instrument itself; contracts for the right to prolong the maturity or maturity of a debt instrument that are not closely related to the host contract; a contractual right embedded in a debt instrument to convert it into equity securities, etc.

Derivative financial instruments

The value of the instrument fluctuates in response to changes in market conditions Relatively small initial investment to purchase The instrument is settled in the future At initial recognition in the balance sheet, the sum of the carrying amounts of the individual elements must equal the carrying amounts of the entire complex financial instrument, as the elements of complex financial instruments are not presented separately. must lead to some financial results- profit or loss.

The standard provides for two approaches to separate measurement of liability and equity elements: the residual method of valuation by subtracting from the carrying amount of the entire instrument the cost of one of the elements, which is easier to calculate; a direct method of valuing both elements and adjusting their value proportionately to bring the sum of the valuation of the parts to the carrying amount of the complex instrument as a whole.

The first valuation approach assumes that for a bond convertible into shares, the carrying amount of the financial liability is first determined by discounting future interest and principal payments at the prevailing market rate. interest rate. The carrying amount of an option to convert a bond into common stock is determined by subtracting the estimated present value of the liability from the total value of the compound instrument.

Conditions for issuing 2 thousand bonds, each of which can be converted into 250 ordinary shares at any time within three years: 1)

the nominal value of the bond is 1 thousand dollars per unit; 2)

total proceeds from the issue of bonds: 2000 x 1000 = = 2,000,000 dollars; 3)

the annual rate of declared interest on bonds is 6%. Interest is paid at the end of each year; 4)

when issuing bonds, the market rate of interest for bonds without an option is 9%; 5)

market price shares at the time of issue - $3; 6)

expected dividends in the period for which the bonds are issued - $0.14 per share at the end of each year; 7)

annual risk-free interest rate for a period of three years - 5%.

Calculation of the cost of elements according to the residual method 1.

Present value of the principal amount of the Notes (2,000,000) payable at the end of the three-year period, adjusted to date ($1,544,360). 2.

The present value of interest payable at the end of each year (2,000,000 x 6% = $120,000), adjusted to date, payable for the entire three-year period ($303,755). 3.

Estimated value of the liability (1,544,360 + 303,755 = = 1,848,115). 4.

Estimated value of the equity instrument - share option (2,000,000 - 1,848,115 = $151,885). The estimated value of the elements of a complex financial instrument to reflect them in financial reporting is equal to the total amount of revenue received from the sale of a complex instrument.

The present present value of the liability element is calculated from the discount table using a discount rate of 9%. In the above conditions, the targets are the market rate of interest for bonds without an option, that is, without the right to convert them into ordinary shares.

The present value of the payment to be made in n years, at a discount rate r, is determined by the formula:

P = -^_, (1 + 1)n

where P is always less than one.

According to the discount table of the current (present) cost of one monetary unit for a one-time payment, we find the discount factor at an interest rate of 9% and a payment period of 3 years. It is equal to 0.772 18. We multiply the found coefficient by the entire monetary amount of $ 2 million and get the desired discounted value of the bonds at the end of the three-year period: 2,000,000 x 0.772 18 \u003d $ 1,544,360.

Using the same table, we find the discount factor for the amount of interest due at the end of each year at a discount rate of 9%. At the end of the 1st year, the discount factor according to the table is 0.917 43; at the end of the 2nd year - 0.841 68; at the end of the 3rd year - 0.772 18. We already know that the annual amount of declared interest at a rate of 6% is: 2,000,000 x 6% = $ 120,000. Therefore, at the end of the next year, the present discounted amount of interest payments will be equal to:

at the end of the 1st year - 120,000 x 0.91743 = $110,092; at the end of the 2nd year - 120,000 x 0.84168 = $101,001; at the end of year 3 - 120,000 x 0.772 18 = $92,662

Total $303,755

Combined for the three years, the discounted amount of interest payments is estimated at $303,755.

The second approach to the valuation of a complex financial instrument involves separately valuing the elements of the liability and the share option (equity instrument), but in such a way that the sum of the valuation of both elements is equal to the carrying amount of the complex instrument as a whole. The calculation was made according to the terms of the issue of 2 thousand bonds with an embedded share option, which were taken as the basis for the first approach to the valuation using the residual method.

Calculations are made on models and valuation tables to determine the value of options used in financial calculations. The necessary tables can be found in textbooks on finance and financial analysis. To use option pricing tables, it is necessary to determine the standard deviation of proportional changes in the real value of the underlying asset, in this case, ordinary shares into which issued bonds are converted. The change in return on the shares underlying the option is estimated by determining the standard deviation of return. The higher the deviation, the greater the real value of the option. In our example, the standard deviation of annual earnings per share is assumed to be 30%. As is known from the conditions of the problem, the term of the right to convert expires in three years.

The standard deviation of proportional changes in the real value of shares, multiplied by the square root of the quantitative value of the option period, is equal to:

0.3 Chl/3 = 0.5196.

The second number to be determined is the ratio of the real value of the underlying asset (share) to the present present value of the strike price of the option. This ratio relates the present present value of a share to the price the option holder must pay to receive the share. The larger this amount, the higher the real value of the call option.

Under the terms of the problem, the market value of each share at the time the bonds were issued was $3. From this value, you must subtract the discounted amount of dividends on shares paid in each year of the specified three years. Discounting is carried out at the risk-free interest rate, which in our problem is equated to 5%. According to the table already familiar to us, we find the discount factors at the end of each year of the three-year period and the discounted amount of dividends per share:

at the end of the 1st year - 0.14 x 0.95238 = 0.1334; at the end of the 2nd year - 0.14 x 0.90703 = 0.1270; at the end of the 3rd year - 0.14 x 0.86384 = 0.1209;

Total $0.3813

Therefore, the current present value of the stock underlying the option is 3 - 0.3813 = $2.6187.

The present price of one share of the option is $4, based on the fact that one thousand dollar bond can be converted into 250 shares of common stock. Discounting this value at a risk-free interest rate of 5%, we learn that at the end of three years, such a share can be valued at $3.4554, since the discount factor for the table at 5% and three years is 0.86384. The discounted value of the share: 4 x 0.86384 = $3.4554

The ratio of the real value of a share to the current present value of the option exercise price is:

2,6187: 3,4554 = 0,7579.

The table for determining the price of a call option, and a conversion option is one of the forms of a call option, shows that based on the obtained two values of 0.5196 and 0.7579, the real value of the option approaches 11.05% of the real value of the shares being acquired. It is equal to 0.1105 x 2.6187 = $0.2894 per share. One bond is converted into 250 shares. The value of the option embedded in the bond is 0.2894 x 250 = $72.35. The appraisal value of the option as an equity instrument, calculated on the entire array of bonds sold, is 72.35 x 2000 = $144,700.

The estimated value of the liability element, obtained by direct calculation when considering the first approach to valuation, was determined in the amount of $1,848,115. If we add estimated values of both elements of a complex financial instrument, we get: 1,848,115 + 144,700 = 1,992,815 dollars, that is, 7,185 dollars less than the proceeds received from the sale of bonds. In accordance with IAS-32 § 29, this difference is adjusted pro rata between the cost of both elements. If the share of the deviation in the total value of the elements of a complex instrument is: 7185: 1,992,815 = 0.003,605 4, then the proportional share of the liability element is: 1,848,115 x 0.003,605 4 = 6,663 dollars, and the equity instrument (option) element is 144 700 x 0.003605 4 = $522. Therefore, in the final version, a separate measurement of both the liability and the option should be recognized in the financial statements in the following amounts:

Liability element value

1,848,115 + 6,663 = $1,854,778 Equity instrument value

144,700 + 522 = $145,222

Total cost $2,000,000

Comparison of the results of calculations in two different methodological approaches to valuation shows that the values obtained differ very slightly from each other, literally by a few hundredths of a percent. And no one can say which of the methods gives a really reliable result. Therefore, the motive for choosing one or another approach to calculations can only be their simplicity and convenience for practical application. In this respect, the first approach is certainly more advantageous.