You may need a salary certificate in many situations: from getting a loan, to applying for assistance from social security authorities, upon dismissal, retirement, and even to travel abroad.

In each case, there are many features in the design of this document. Information about them will be useful for both an employee, an entrepreneur and a civil servant, because each of them has its own sample salary certificate.

Purpose of the document

The main task of a salary certificate is to confirm the employee’s place of work, position and profit. It is issued by the HR or accounting department of your organization. This certificate will be given to you no later than three business days after you submitted a written application to receive it.

For loan

To apply for a loan, you need to submit not a copy of the certificate, but its original. Using this document, the loan officer determines the borrower's income level. The amount of loan you can get depends on it.

Credit institutions trust certificates that, in addition to income, indicate the amount of taxes paid, alimony, repaid loans and the borrower’s “white salary” more.

To protect against fraud, some banks ask you to include the phone number of your organization's accounting department or management. They may also need a certified copy of your work record or an extract from it.

For social security authorities

There are many nuances in the sample salary certificate for social security authorities:

- It must additionally indicate your position and information about hiring.

- Since benefits for low-income people and children with many children are issued quarterly, the certificate must include the total income for the last quarter.

- It is also necessary to indicate all profits for the last 60 months: not only wages, but also bonuses, scholarships, and temporary disability benefits.

- There is no need to enter one-time payments and withheld income tax.

- To index salaries by the Pension Fund, income is listed by month and year based on information from the organization’s personal accounts.

- If the organization no longer exists, the salary certificate must be obtained from a higher organization or archive.

- If you submit a certificate to the Pension Fund, it must indicate that you have paid all insurance premiums in full. Otherwise, you may be left without a pension.

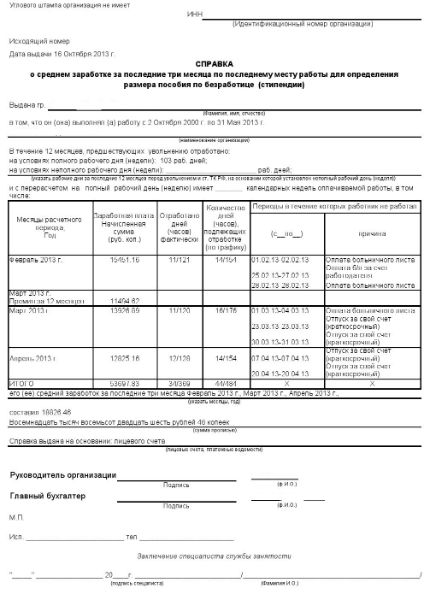

For the labor exchange

If you have been fired from your job and you want to register with the employment service, then you must provide a certificate of income for the last quarter certified at work.

It must indicate the following:

- Your identification code (needed by the tax office to avoid problems when checking income by the tax office).

- Job information: dates of hire and termination, notes regarding part-time work (if any).

- Your average monthly earnings, calculated based on income data for the last year.

- Separately, you need to indicate periods that were not taken into account when calculating the average salary: absenteeism, vacation at your own expense, downtime due to your fault, etc.

Obtaining a visa

To obtain a US visa, you must earn at least 30,000 rubles, to Great Britain – from 17 000, to Schengen countries – not less than 12,000. A salary certificate is needed to confirm that you have the required income.

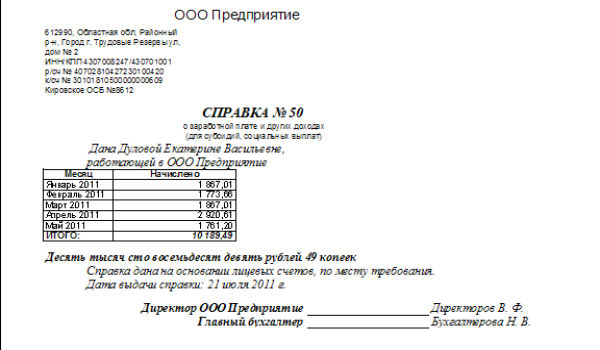

The sample salary certificate contains a set of standard items:

- Company details.

- Your position and income for the last six months and year.

- The certificate must be certified with a company stamp, as well as the signature of an accountant or manager.

Receipt rules

To receive a salary certificate, you must submit a written application. You can bring it yourself, send it by mail or give it with the help of your legal representative. The certificate is issued within three working days from the day you submitted the application.

There is no common standard for issuing a salary certificate, with the exception of its issuance upon dismissal. In this case, it is filled out on the form prescribed by law.

The certificate must be signed by the head of the organization, the chief accountant, as well as the head of the human resources department.

Who issues?

The salary certificate is issued by the accounting department or the head of the organization in which you work. An employer is prohibited from refusing to issue this document to you, even if you no longer work for their company.

Average monthly, for 3 months, for 6 months

To calculate your average monthly earnings, you need to divide the amount of income for the last year by the number of days you spent at work. In addition to salary, this amount takes into account additional payments and bonuses. We multiply the result by the number of days spent at work in a particular month. Using the same scheme, salaries are calculated for 3 months and six months.

When calculating for any period, days when you went on vacation at your own expense, were absent, or were late in work are not taken into account.

Required information

There is no sample salary certificate that is the same for everyone, but there is a set of standard items that are required to be filled out.

For the organization that issues the certificate, this is:

- full name of the organization,

- identification and state registration number,

- legal address of the organization,

- contacts of the accounting department or recruitment department.

The employee must provide the following information about himself:

- identification code,

- passport details and registration address.

Validity

The validity period of a salary certificate in different cases varies from 10 days to six months. But most often it is suitable for 1 month from the moment of filling.

If the company is liquidated

If you need to prove your income to calculate your pension, you may find that the organization you worked for no longer exists.

To obtain a salary certificate in this case, there are the following options:

- Try to find your organization's archive.

- Contact a higher-level organization or the liquidator of your place of work.

- If you were unable to obtain the certificate yourself, your income can be established in court.

For individual entrepreneurs

The sample salary certificate for individual entrepreneurs differs significantly from its execution by an employee.

There are a number of aspects in this process that are unique to individual entrepreneurs:

- Under no circumstances should you issue a salary certificate for an individual entrepreneur in any form: on a simple A4 sheet without company details, simply certifying it with your stamp and signature. Such a certificate is not quoted by any authorities.

- To obtain a loan, the bank can provide its own form for reporting income, but generally individual entrepreneurs must obtain a salary certificate from the tax office.

- The declaration is drawn up using a special form 3-NDFL. It must have a mark indicating that the tax authority accepted it. The type of taxation system is not taken into account.

- You can also send a request for a salary certificate to the tax office. No later than 5 days later, you will be given a document that will indicate the income from your declaration.

- An individual entrepreneur can issue salary certificates to his subordinates, but cannot issue them in his own name.

- Sometimes, along with the standard return, you also need to provide a return on income for the tax system you apply. It also needs to be certified by the tax office.

Some entrepreneurs, before checking their income, prepare their profit reports in triplicate in advance. At the same time, they keep two copies for themselves for the future.

Fill out form

The income certificate must be filled out in black or blue pen or typed on a computer or typewriter. You cannot make any edits or erasures. The sample salary certificate can be filled out in any font and additional lines can be added to it in order to make the picture of income more complete. These changes should not affect the amount of benefits calculated for payment.

State

For civil servants there is a special sample salary certificate, approved by the President of the Russian Federation. This form consists of 9 pages on which you need to fill out 5 sections about your different types of income and property.

Let's get acquainted with the main aspects of filling out this document.

- On the title page you must indicate personal information, namely, full name, date of birth, place of service, position, home address. When filling out a certificate for yourself, in the “you” column you must indicate that you are applying for or occupying a public position. When filling out a certificate for a family member, in the “you” column you must indicate “I want to report income” and indicate the corresponding relative.

- In section 1 you must indicate the amounts of all your income for the reporting period. This list also includes pensions, benefits and other payments.

- In section 2 you must separately describe your real estate and transport. The item “Real estate” indicates all land plots, apartments, houses and other real estate. For each item you need to describe its type of property, address and area. The “Vehicles” section indicates the type of ownership and place of registration of all vehicles that you own.

- In Section 3 you need to describe the contents of your bank accounts.

- The fourth section is devoted to securities. First, you need to describe your shares and other types of participation in commercial organizations, indicating the name of the organization, its address, total official capital, your share and the basis for participation. Separately, you need to indicate other securities, such as bills, bonds, etc., which are not included in this paragraph. At the end, you need to calculate the total value of all your securities.

- In the fifth section, you must provide information about your property, leased or for free use, as well as loans, credits and other obligations.

In free form

The income certificate, which is issued officially at your place of work, displays only the “white” salary and is not suitable for you if you work unofficially. In this case, it is necessary to provide a salary certificate in free form. It is also an official document, since it is certified by the employer. This certificate is issued on the organization’s letterhead and must bear the seal and signatures of the manager and chief accountant.

This is an official document confirming “gray” income. It is accepted in many banks when issuing a loan. Loan rates do not depend on the document you use to confirm your income, that is, with this certificate you will receive a loan on the same terms as other bank clients.

Now, armed with all the necessary knowledge, you can easily make a salary certificate, regardless of its purpose and type of activity. You will also be able to check the correctness of its execution and will know exactly when the employer must provide it to you.