When an employment contract with an employee is terminated, he may not immediately find a job, but register with the employment service at his place of residence. To carry out this procedure, this government agency will require the collection of a certain package of documents, among which a special place is occupied by a certificate of average earnings for the employment center.

A certificate of average earnings for the employment center is submitted by the resigned employee to this service for registration and receipt of unemployment benefits.

These amounts will be paid to the former employee of this service within a specified period, during which a new job will be found for him.

At the same time, a person can register without this certificate, since it is not part of the documents required for this procedure. But if the dismissed employee does not provide it, the benefit will be calculated according to the minimum amount in accordance with the rules of law. This rule is enshrined in employment legislation.

Attention! It makes no sense for a former employee to take a certificate of average earnings at his old place if he was terminated for an offense he committed, for example, he was. A labor exchange specialist can view this information in the employee’s employment record, which is registered. The employment center will accrue benefits to him at the minimum amount in any case.

At what point should a certificate be issued?

A certificate of average earnings for determining unemployment benefits is not part of the mandatory documents that the administration must draw up at the time of termination of an employment contract with an employee.

It is drawn up when a fired or resigning person receives a request for the head of the company. According to the law, the accounting department is obliged to draw up this document within three days from the date of submission of the application for the generation of this form.

Except for the case when he asked to give it away while still an employee of the company. In this case, it is drawn up and transferred to the person being dismissed on the last day of work of this person.

Attention! An employee who quits can request it immediately at the time of dismissal or apply a little later. The employer does not have the right to refuse this request, even if a year or more has passed since the termination of the contract with this person.

For what period should information be provided (for how many months)

The Employment Law regulates that a certificate of average earnings for an employment center must be drawn up for three full months preceding the date of dismissal of the employee.

This norm distinguishes this process of determining average earnings from calculations according to the general rule. For example, if you quit on September 18, the payroll period is taken from June 1 to September 1.

From this time, the accountant must exclude the following periods:

- Vacation time, when his place of work was retained and vacation pay was paid;

- Periods of incapacity;

- Downtime that occurred through no fault of the employee;

- Time off;

- The time of child care provided to the employee additionally, for which payment was made;

- The period of a strike when the dismissed person did not take part in it, but because of it could not work;

- The time when the employee did not work with payment of wages in whole or in part.

- Periods when the employee used his time off.

Attention! In practice, it may turn out that this billing period will not contain either the employee’s salary or the days actually worked. Then, as the calculation period, you can take the full three months preceding this time.

Certificate of average earnings for the employment center form 2019 sample

Attention! There is a form established by the Ministry of Labor for submitting information to the employment center about average earnings. And also in each city the employment center can develop its own form.

Certificate of average earnings to the employment center, sample form 2019

There are two types of this certificate. There is an official form that was developed and put into effect by the Ministry of Labor in 2016. Let's look at how to fill it out correctly. It should be noted that there are no official rules for preparing a certificate.

Sample of filling out a certificate for an employment center according to the Ministry of Labor form

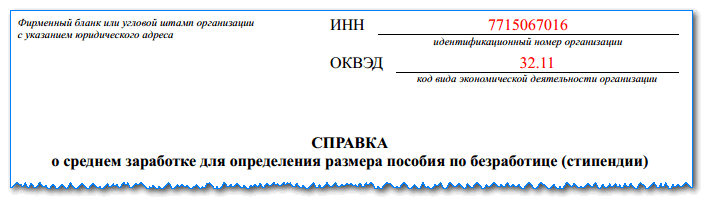

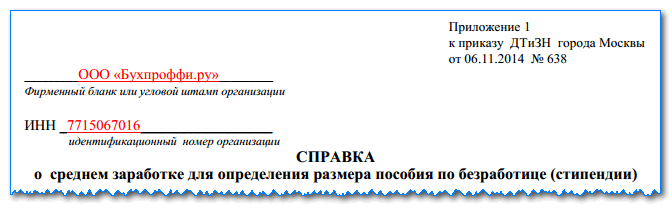

In the upper right corner you need to put a stamp with the company details. Opposite it on the left are the TIN and OKVED codes. The latter is placed without text decoding.

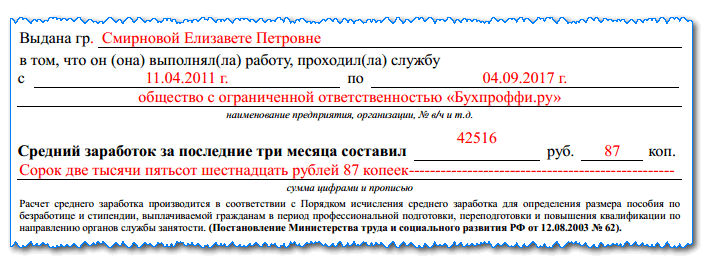

IN in the column “Issued by card.” full name must be indicated. the employee for whom the document is being filled out. After this, the dates defining the beginning and end of the period of work at the enterprise are entered in columns “From” and “To”. The full name of the company or full name is written under them. entrepreneur.

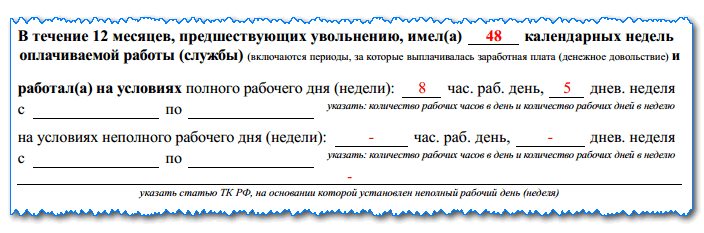

Next, you need to indicate in numbers the number of weeks during which he worked for the company over the past 12 months.

Next, columns are displayed where you need to indicate the number of hours per day and the number of days per week during which the employee performed duties on a full-time and short-time basis. If the work was carried out part-time, then in the column below you need to write down the article of the Labor Code that served as the basis for determining such a schedule.

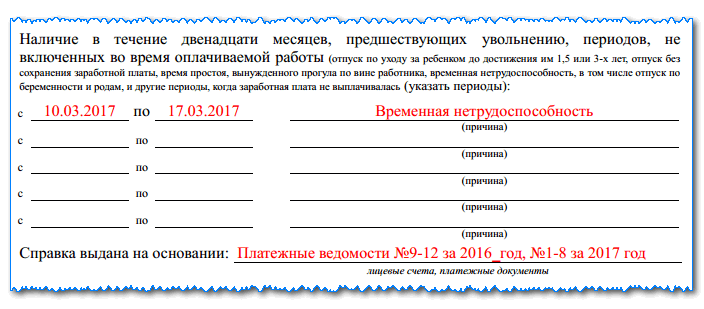

Next comes a block graph of 7 pieces (we had 5 pieces - they reduced it because it didn’t fit), in which you need to enter periods for the last 12 months during which the employee did not receive wages (this could be vacation without pay, sick leave, idle time etc.). The information is indicated in the following form - the start and end dates of this period, as well as its name.

IN column “Certificate issued on the basis of” information about the documents on the basis of which the filling was carried out is recorded.

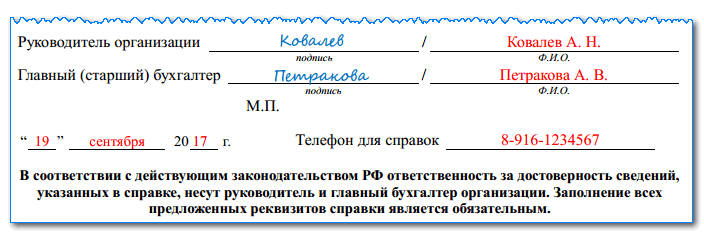

The certificate must be signed by the director and chief accountant, with a transcript of their signatures, after which the date of registration of the certificate and a contact telephone number for clarification of information are indicated below.

If any of the lines is not used (for example, in conditions of a short day he did not perform labor duties), a dash is placed in these columns.

In addition, each of the subjects of the country has the right to develop and implement its own certificate form. In this case, most often regional authorities require the provision of certificates in their own form. Typically, this option is simpler and contains fewer required fields for entering data.

Sample of filling out a certificate for the employment center in Moscow

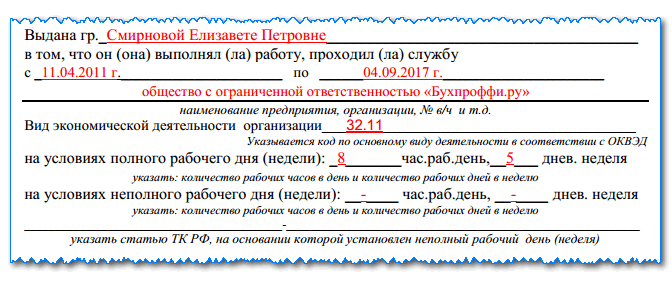

Further after the words “Grand issued.” you need to write down your full name. the person to whom the certificate is drawn up. Below, in columns “From” and “To”, the dates during which he worked at this enterprise are recorded, and in the next column the name of the company (full name of the entrepreneur) is recorded.

Then you need to enter the activity code in the form of numbers (decoding in words is not required).

This is followed by lines where it is necessary to enter the number of hours per day and days per week during which he worked full-time or short-time.

If an employee was assigned to work part-time, then in the appropriate column it is necessary to make a link to the article of the Labor Code of the Russian Federation under which this was done.

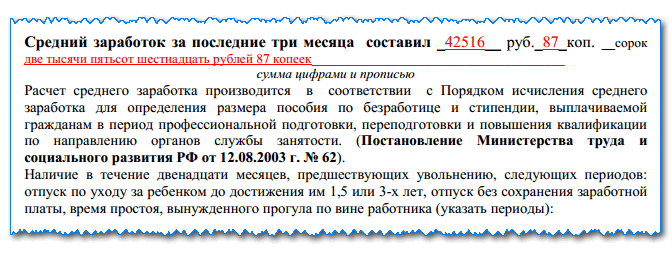

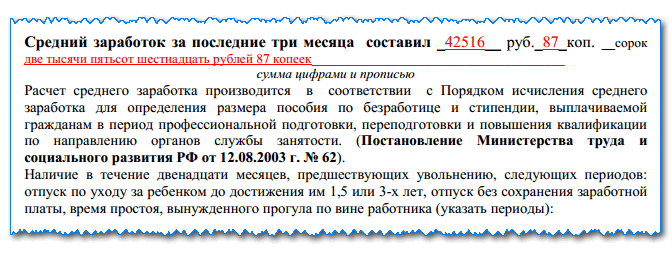

The accountant must first determine the average earnings for the previous 3 months, and enter its amount into the certificate, first in numbers and then in words.

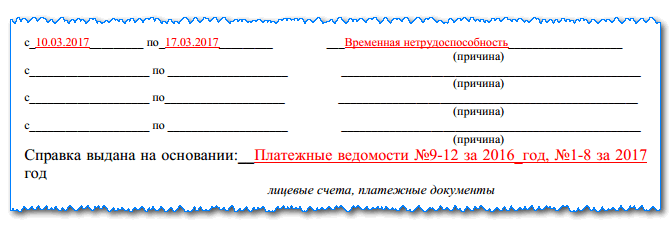

If over the last 12 months the employee has had periods of leave without pay, for child care, periods of downtime, disability, etc., they must be indicated below in the following form: the start and end period, as well as the reason for the period.

IN column “Certificate issued on the basis of” you need to reflect the details and names of the documents from which the information necessary to fill out was taken.

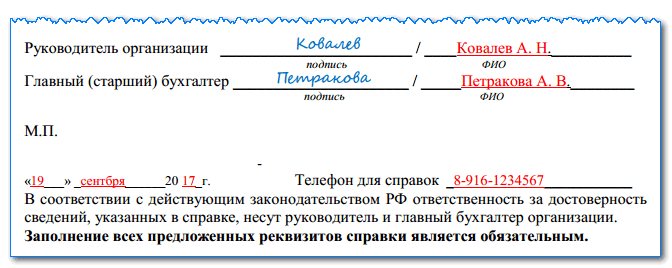

After filling out the certificate, it is signed by the head of the company and the chief accountant, and a seal is stamped (if any).

Below you need to write down the date the document was filled out and the number at which you can contact the person in charge to clarify the data.

Responsibility for failure to issue a certificate

Labor legislation does not define punishment as such if the employee was not given a certificate of average earnings for the employment center upon dismissal, or upon submission of a written request.

But since this document is mandatory, which the employer must draw up for the employee when submitting a written request, the latter can contact government agencies to protect his rights.

He has the right to file a complaint with:

- Labor Inspectorate;

- Prosecutor's Office;

- Judicial authorities.

The Code of Administrative Offenses establishes the following liability for violations of the Labor Code of mild severity that do not cause harm to health or life:

- For an official - a warning or a fine from 1 to 5 thousand rubles.

- For a legal entity - a fine of 30 to 50 thousand rubles.

A warning is a measure of punishment, which is expressed in official written censure of the guilty person.

If the violation is repeated:

- For an official - a fine of 10 to 20 thousand rubles;

- For a legal entity - a fine of 50 to 70 thousand rubles.