Every depositor, when placing a deposit in a bank, wants to know how much income can be received at the end of the term. Today, there are two main ways of calculating interest: complex and simple, and each financial institution calculates profits in its own way. In this article we will look at how to calculate the interest on a deposit.

What types of agreements are there?

Interest calculation schemes can be complex and simple, while the simple calculation scheme is that interest is accrued either at the end of the contract term or to a separate account from which the client can withdraw it once a month or quarter.

The second scheme involves capitalization of interest, that is, accrued interest is added to the deposit amount, increasing it. In the next period, interest income is calculated from the already increased deposit amount.

A complex scheme is more profitable because it allows you to get more income. However, the rates for such programs are lower.

Basic formulas

Simple option

The formula for calculating interest on a deposit must be specified in the terms of the agreement.

It looks like this:

, Where:

Let's give an example. The investor deposited 10,000 rubles. Annual rate – 10% per annum. The deposit program does not involve replenishment and capitalization.

According to the calculation using this method, we get:

Thus, for 3 months deposit the client will receive interest in the amount 246.6 rubles.

Simple interest is also applicable in cases of replenished deposits. In this case, the calculation is carried out as follows.

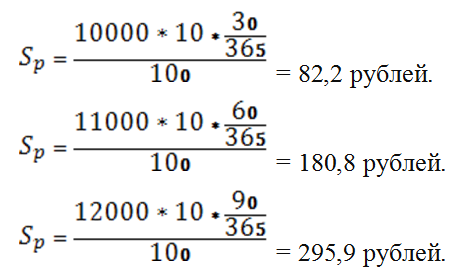

The client put 10,000 rubles under 10% per annum, for a period of 3 months. The deposit was replenished twice 1000 rubles. The first one is through 30 days, the second – in two months.

This way the client will receive 82.2 rubles in the first month before the deposit is replenished, and 180.8 rubles And 295.9 rubles in the second and third periods, respectively.

Complex version

A complex calculation method involves capitalization of interest. Let's look at the diagram as an example. The client placed a deposit 100,000 rubles at the rate 8,7% , for half a year. Terms of deposit – p. The calculation is made as follows.

S = 100000 * (1+8.7*30/365/100) 6 – 100000 = 4367.9 rubles.

At the end of the deposit period the client will receive 4367.9 rubles additional profit. It is very easy to check the calculation using the simple interest formula. To do this, the deposit period is divided into separate periods and the balance is taken for calculation, taking into account previous payments and accruals.

| Month | Deposit amount | Interest rate | Amount of days | Interest amount | Deposit amount at the end of the period |

| 1 | 100000 | 8,7% | 30 days | 715,1 | 100715,1 |

| 2 | 100715,1 | 8,7% | 30 days | 720,18 | 101435,28 |

| 3 | 101435,28 | 8,7% | 30 days | 725,34 | 102160,62 |

| 4 | 102160,62 | 8,7% | 30 days | 730,52 | 102891,14 |

| 5 | 102891,14 | 8,7% | 30 days | 735,74 | 103626,88 |

| 6 | 103626,88 | 8,7% | 30 days | 741 | 104367,88 |

Thus, the table shows that the compound interest formula is simpler to use than calculating a deposit with capitalization using simple interest.

By substituting deposit values into the formulas, you can independently calculate the final income

For an account with top-ups

Deposit programs with replenishment also have features for calculating interest.

The annual rate for such deposits is slightly lower. This is explained by the fact that during the period of validity of the agreement the refinancing rate may decrease, and the deposit will become unprofitable for the bank.

Let's give an example of calculating interest on a deposit with replenishment.

The client opens a deposit in the amount 70,000 rubles at the rate 7% per annum for 3 months.

For the first month your income will be:

After replenishing the deposit to 3000 rubles, the account contains an amount of 73,000 rubles.

Recalculation for the year:

Income for the remaining 60 days:

The total amount of interest on the deposit for three months will be 1242 rubles from the amount in 73,000 rubles. And the final deposit amount 74242 rubles.

Important caveats regarding contribution percentage calculations

Effective rate

The effective interest rate allows you to estimate the real income from a particular deposit. It is this rate that allows you to compare different offers from banks and choose the most profitable ones.

Since the capitalization of deposits significantly affects the income from the deposit, the effective rate is calculated using the following formula:

S effective = ((1+I/100/n) n – 1) x 100

, Where:

Let's present the calculation using an example. The deposit is placed in the bank for 1 year at 10% per annum. Interest capitalization is monthly.

S effective = ((1+10/100/12) 12 – 1) x 100 = 10.43%

The effective annual interest rate in this case will be 10,43% .

That is, when choosing a deposit, it is necessary to compare the effective rates. Today there are enough online services for calculating deposit rates. Similar calculators can be found on bank websites.

Taxing

Any income of a citizen of the Russian Federation established by law is subject to tax. In the case of a bank, such income is recognized as the percentage of excess of the refinancing rate.

As of August 2017, the refinancing rate is not set. From January 1, 2017, the Central Bank of the Russian Federation decided not to allocate refinancing as a separate rate, but to equate it to the key rate.

The key rate in 2017 is 11% , which means that if the interest on the deposit is higher than this value, then personal income tax must be charged on such income - 35% .

Let's turn to the legislation. Data on taxes paid by individuals on income is considered in Article 214.2 of the Tax Code of the Russian Federation, as amended and supplemented as of the date of application. So, you can make simple calculations.

If the client places a deposit of 10,000 rubles for a period of 1 year at a simple interest rate of 12.3%, then upon expiration of the agreement he will have to pay to the tax office:

- 10000 *12,3% = 1230 rubles;

- 10000*11% = 1100 rubles;

- (1230-1100)*35% = 45.5 rubles.

Thus, in the example under consideration it is clear that taxes will be 45.5 rubles. The bank handles the deduction of taxes, and the client will simply receive a reduced amount.

Dependence on timing

The final income from the deposit depends on the timing and calculating it manually is quite simple.

For a deposit of 10,000 rubles at an annual rate of 8%, we will calculate as follows:

- Let's determine what the daily accrual is equal to 1% : 10000/100 = 100 rubles;

- multiply by the amount of interest the bank gives: 100*8 = 800 rubles;

- add the percentage to the deposit body: 10000 + 800 = 10800 rubles.

If the money is placed not for a year, but for another period, then the percentage is more difficult to calculate. Let's look at the same example, but the deposit period will be 182 days.

For the year the profitability will be 800 rubles. Behind 1 day year the investor will receive: 800/365 = 2,192 rubles. This is the cost of the deposit, calculated daily. The terms of the deposit in the example state that the term is 182 days, accordingly it is necessary to multiply this period by daily income: 182 * 2.192 = 398.9 rubles.

In banks, deposit terms are indicated in months or years, but days are still used in the calculation.

So, common terms are:

- 1 month - 30 days;

- 3 months - 90 days;

- six months - 182 days;

- year - 365 days.

With a replenished deposit, the process is more labor-intensive. In this case, you can use an online calculator.

An example of how to check the total

When calculating on a calculator, the wrong amount may be given, since the technical factor always exists. If the deposit was opened earlier and you have an account statement with all the accruals, then it is very easy to check the correctness of income accrual.

For example, on February 20, the client opens a deposit with quarterly capitalization. Deposit amount 10,000 rubles, bid 10% . Term - 9 months or 272 days. Removed on August 15 5000 rubles.

| Days | date | Coming | Consumption | Account amount |

| February 20, 2017 | 10000 | 0 | 5000 | |

| 49 | April 10, 2017 | 30000 | 0 | 35000 |

| 42 | May 20, 2017 | 535 | 0 | 35535 |

| 85 | August 15, 2017 | 0 | 5000 | 30535 |

| 6 | August 20, 2017 | 744,77 | 0 | 31324,95 |

| 91 | November 20, 2017 | 789,95 | 0 | 32027,83 |

- From February 20 to April 10: 10000*9/100*49/365 = 120.8.

- From April 10 to May 20: 40000*9/100*42/365 = 414.2.

- From February 20 to May 20: 120.8 + 414.2 = 535.

- From May 20 to August 15: 35535 * 9/100 * 85/365 = 744.77.

- From August 15 to August 20: 30535 * 9/100 * 6/365 = 45.18.

- From May 20 to August 20: 744.77 + 45.18 = 789.95.

- From August 20 to November 20: 31324.95 * 9/100 * 91/365 = 702.88.

Online calculators

Online calculators are created for the convenience of users. Almost every site has loan, deposit and mortgage varieties. You can use the deposit calculator to calculate deposit payments.

When filling out the data, you should pay special attention to the specified conditions, such as capitalization, prolongation, interest rate and deposit terms. This will allow you to most accurately calculate future income.

Thus, you can calculate the interest on the deposit yourself. To do this, you need to know the exact terms of the deposit and the basic concepts of the deposit agreement.

The calculation on the calculator may differ from the bank calculation by several tens of rubles, since the amount is rounded. For this reason, when drawing up an agreement, it is better to ask a bank specialist for an authentic bank statement for a specific deposit program.