The law of the Russian Federation in the field of tax legal relations states that having paid for the provision of educational services, a citizen has the right to receive compensation - the so-called deduction, represented by part of the monetary expenses incurred. In this article we will tell you how to fill out a declaration for a 13 percent refund for studies.

A tax deduction is a part of an individual’s income that is not subject to taxation. You have the opportunity to return the deductions paid to the state, transferred from the costs of education. To do this, you must be an officially employed employee of any organization in accordance with the legislative norms of the country, pay automatic income tax and be a student, or pay for the education of relatives. The list of this category of people does not include all relatives, but only:

- brothers;

- sisters;

- children (natural, adopted);

- wards;

- under guardianship.

If you paid for your studies for any subject from the above list or for yourself, then you can return a substantial piece of the cost of your completed or ongoing studies, taking into account modern prices an impressive 13%.

You have the right to use this type of social tax deduction in the following cases.

Table 1. Who gets the deduction?

| Who can claim the deduction? | |

|---|---|

| Option 1 | First of all, this opportunity is available to those who have paid for educational services in institutions that are official and specialized in this area. Among them: |

| Option 2 | If you are an officially employed employee, and monthly personal income tax is deducted from your income to the state treasury. |

In order to receive a refund for the education of relatives, the authorities have established some restrictions that directly relate to the form of education that a family member must be in in order for the payer to receive a refund of partially paid tax.

However, if the training is carried out directly by the employee and he is also the payer, he has no strict restrictions and the form of attendance at the classes for him can be as follows:

- correspondence;

- full-time;

- and evening;

- any other.

The amount of funds received for your own training

The amount of funds returned for training payments is determined based on many circumstances.

- It is understood that it is impossible to receive compensation for studies, the amount of which will exceed the funds transferred from your salary to the country's budget for personal income tax.

- The maximum deduction amount provided to a Russian citizen is 120 thousand rubles, therefore, you cannot return more than thirteen percent of this amount. It turns out that 15 thousand 600 rubles are due for refund.

The described restriction is valid not only for the return of funds for accounting, but also for all other types of deductions of a social nature, excluding the category of charitable payments and receipt of expensive treatment.

In total, all social compensation received from the state cannot exceed the required amount of 120 thousand rubles, that is, for all of them the maximum amount provided is 15 thousand 600 rubles.

Let's give an example. You completed your studies at a higher educational institution and spent 150,000 units of Russian currency on educational services. At the same time, during the reporting year, you received a salary in the amount of 250,000, and paid personal income tax on them in the amount of 31,000. According to all the criteria, you have the right to a refund of compensation funds from the state, however, the costs incurred will not be fully repaid by you, despite how much you paid to the treasury and how much you gave to the educational institution. The maximum amount stated above is what you are entitled to in the case presented.

Receiving a deduction for education for children

You have the right to receive social compensation in the form of a refund of part of the tax paid to pay for your children’s education if your situation meets the criteria required for compliance.

- The child for whom the funds are being returned may be an adult, but must not reach the age of 24 full years.

- The offspring’s education is carried out in a full-time format, and it does not matter what he attends. This could be a university, a school, or even a kindergarten; a full uniform is required and personal attendance is required.

- A formal agreement on the provision of educational services is drawn up in the name of one of the parent-spouses.

- Documents confirming the payment must be drawn up in the name of the person making the payment, or the payment was made on behalf of an attorney whose status is confirmed by a notary.

Note! The amount of compensation for the child has decreased relative to that offered to the payer, provided that he has undergone training. In this case, it is only 50,000, that is, you can return 13% of this amount - 6.5 thousand rubles.

Let's give an example. Last year you paid 30,000 rubles for your eldest daughter’s correspondence education at the local “University of Culture and Arts” in your city of residence, and another 40,000 for your youngest daughter at a private school. The salary and amount of tax paid for you remained the same as in the previous problem, that is, 250 thousand and 31 thousand rubles, respectively.

Since the eldest child is not studying full-time, it will not be possible to return the money for her, but the younger girl attends school in a standard format, even though it is private, it turns out that you can claim a return of 5,200, which represents 13% of the amount spent of 40,000 .

Reimbursement of funds paid for the education of a brother or sister

You will receive the discussed type of social compensation from the state for the listed relatives in the following cases.

- If they are minors or have reached the age of majority but remain under 24 years of age.

- They must attend the place where they receive educational services in person, just like your children. We are still talking about any format of educational institution, be it a university, school, kindergarten, college, etc.

- Formal agreements were drawn up on paper in your name.

- Payment papers confirming the costs incurred must be paid by you or a notarized authorized representative.

As for this category of relatives, you can receive compensation for their receipt of educational services in the standard amount - 13%, with the maximum amount eligible for provision being 120,000 rubles. At the same time, you have no right to receive more than the funds paid to the treasury for tax deductions from your own wages.

Let's give an example. You pay money to help your elderly parents and put your younger brother, who wants to become an engineer, into full-time higher education. The amount of the payment made is 80 thousand rubles. Salaries and the amount of personal income tax paid to the country’s treasury remain the same: 250,000 and 31,000 per year, respectively. It turns out that you are entitled to a refund of 13% of 80,000, namely 10,400 units of Russian currency.

Procedure for receiving a deduction

The process that a taxpayer must go through to receive compensation funds consists of four stages:

- preparation of documents;

- transfer of documents to the tax service;

- checking the correctness of documents and calculations;

- issuance of funds to the payer.

It must be said that there are many paid and free assistant services on the Internet that help you prepare and collect all the missing documents, and also instruct you on the sequence of submitting them for review. However, you can cope without their help, believe me, since the process under discussion is actually complicated only by its high degree of bureaucracy.

Documents for tax deduction for education

To apply for a refund of the funds spent on training, you need to take the following to the inspection specialists:

- declaration form according to the form;

- an official paper agreement with the desired institution providing educational services, in the original.

- payment papers that confirm expenses incurred;

- a copy of the license of the desired educational institution that receives payments from students;

- citizen's identity document;

- a certificate in the form taken from the accounting department at the place of work, confirming that tax payments have been made to the country's treasury;

- a statement in which you declare your right to a tax refund, in the original, with the details of the bank account indicated inside, to which the transfer will subsequently be made.

Note! If you have changed several jobs in one year, providing a 2-NDFL certificate is required from each of them. It is obtained by writing an application to the accounting department for the issuance of the required document.

Collecting documents is the most difficult stage of the process

Don't know how to fill out forms? You can familiarize yourself with these topics on our portal. Step-by-step instructions, sample forms, and how to avoid basic mistakes when filling out a declaration.

It is also important to keep in mind that if, during the course of receiving education, the price for educational services increased several times, each time it is necessary to provide a separate agreement or annexes to it, updated each time the cost increases.

If funds are received for a child, you must additionally provide the following documents in addition to the documents listed above:

- a photocopy of the student’s birth certificate;

- a document confirming the fact that the child is undergoing full-time education and not any other form;

- If one parent paid and the other receives a deduction, a copy of the marriage certificate is required.

As for the case when payments are made in favor of a brother or sister, it is necessary to provide:

- their birth certificate;

- own birth certificate;

- certificate of completion of full-time training.

For those who use foreign educational services, all foreign documents, translated and notarized, must be delivered to the tax office.

Note! To save your time and at the same time avoid fines for incorrectly provided information, first prepare all the documents that may be needed, fill them out correctly, and then go to the service department.

Refunds for educational services are possible only for those annual periods when the funds were deposited. However, filing a declaration and returning funds is possible only in the twelve-month period following the year of payment. It turns out that if the tuition payment was made in 2015, then the funds can only be returned in 2016 and the like.

If the submission of documents for some reason was not made on time, then do not worry, this can be done later, but no later than 36 months from the date of payment, since according to the law, it is during this period that it is possible to receive a refund of part of the tax deductions.

The full process of obtaining funds usually lasts about a third of a year.

Note! Since the beginning of 2016, the possibility of returning social compensation directly through the employer has become available. There is no need to wait until the end of the current year period.

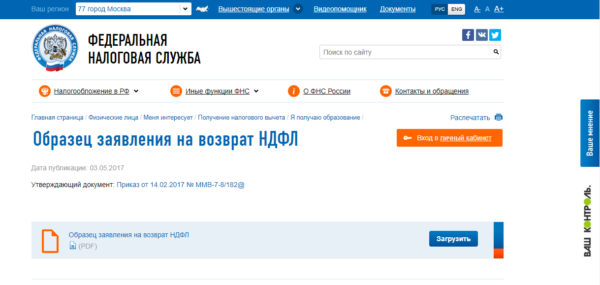

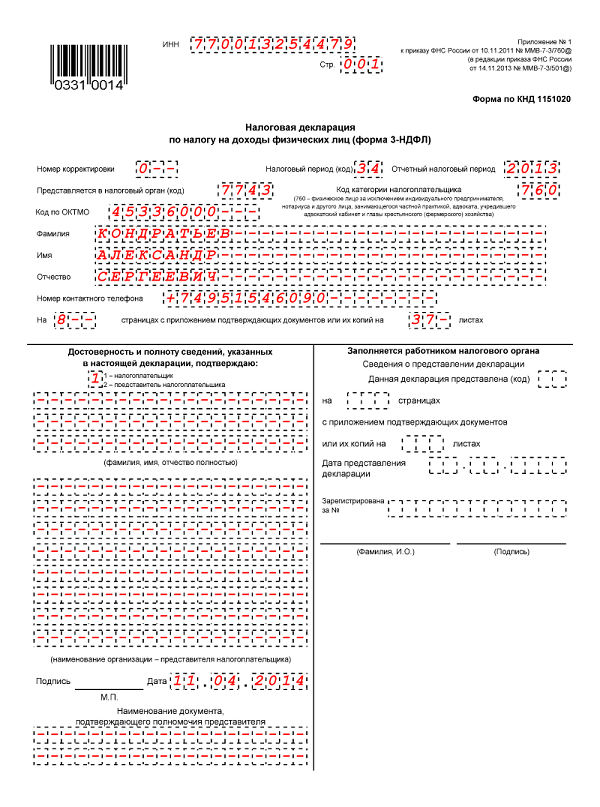

Declaration 3-NDFL

This declaration is always used when it comes to filing a deduction, and it does not matter what type it belongs to. You can fill it out yourself or through a program specially created by the Russian Tax Service, which is downloaded on the official electronic resource.

If you chose the manual filling method, then download the current form there, on the main web resource of the service, finding it as an attachment to a specific order. Or you can download this form from our article.

Those who use the program will significantly shorten the filling process, thereby affecting the overall duration of the entire process, since they will be able to avoid making various mistakes as much as possible. Having opened the first tab after launching the program, you must immediately indicate who the income tax payer is who is applying for compensation. Choose the meaning of an individual who is not an individual businessman, and his only source of income is his official place of employment.

The taxpayer category includes an individual “other”; the type to which the completed declaration belongs must be entered automatically. We are talking about the format of the form, that is, its marking - 3-NDFL.

Please note that most often the program sets the above parameters immediately, automatically, so all that the payer will need to enter on his own is the code of the tax inspectorate to which he belongs according to his place of residence, that is, the department that ultimately receives the documents under discussion.

Then enter information about yourself, since it was you who made the payment for educational services. This information includes:

- Full Name;

- taxpayer identification number;

- official registration;

- day of birth;

- the place where your birth took place.

Then you enter information into the certificate regarding the funds received at your workplace in the form of income for each month. At the same time, they indicate the amount of payments made monthly to the country’s treasury. You need to find information on the described columns inside the 2-NDFL certificate form, which you previously requested from the accounting department at your place of employment.

Next, move on to the main thing. Indicate the amount of funds spent on training in the tab with the appropriate name. Thanks to the data received, the program from the Federal Tax Service of the Russian Federation will automatically generate a declaration form.

The disadvantages of drawing up a document without using the required software are that you yourself will have to enter encodings inside it, indicating specific categories of taxpayers, funds received by them, etc.

As for filling out the form for a child, or a brother and sister, it is also done by you, that is, by the payer, so the procedure has few differences from the first method we described above. It’s just that this time the money spent on training will be indicated in a different column; at the same time, the package of documents actually submitted to the inspection will contain other components.

The maximum amount possible for provision also changes in the case of children, but if compensation is for a brother or sister, then its amount remains the same.

Let's give an example. In 2015, you spent 86 thousand rubles to pay for your eldest daughter’s university education. You received an official document confirming that she is studying full-time and provided it to the tax office along with other necessary documents.

At the same time, your salary in the same year amounted to 550 thousand 300 rubles, and it was taxed and reduced monthly at a rate of 13% personal income tax. As we remember, the maximum amount eligible for refund in this case is 50 thousand rubles. It turns out that it is from this account that you are applying to receive 6 thousand 500 rubles, the return of which can be processed directly at your workplace.

Video - Tax deduction for education

Let's sum it up

The declaration for registration of a tax deduction, be it social, property or another format, will always be drawn up the same - in the form of a form labeled 3-NDFL. It has become very easy to fill it out today, because the tax service has developed a special program that helps to get around the “sharp corners” in the form of coding and other bureaucratic elements that are extremely difficult for the average person to understand. It is available to those citizens who today have the Internet or a computer. Thanks to the globalization of the network and Internet technologies, almost all categories of the population today have these benefits, so difficulties in practice should not arise.

Be careful when filling out, collect the package of documents slowly and do not miss the opportunity to return a significant part of the funds spent on educational services.