The PM form (quarterly) must be submitted to the territorial statistical bodies at the end of the quarter - by the 29th day of the month following the corresponding quarter, by those legal entities that:

- classified as small businesses;

- were included in the Rosstat sample.

Small businesses include firms in which:

- employs from 15 to 100 people (subparagraph "a", clause 2, part 1.1 of article 4 of the law "On the development of small and medium-sized businesses" dated 24.07.2007 No. 209-FZ);

- annual revenue is up to RUB 800 million. (Clause 1 of the Decree of the Government of the Russian Federation of 04.04.2016 No. 265).

Rosstat collects data on small businesses within the framework of quarterly sample surveys - forming a representative sample of enterprises (clause 3, article 5 of Law No. 209-FZ). The lists of firms in the sample are usually published on the websites of the territorial offices of the department.

However, the data on this site is not always correct. Read more about this in the material. "Attention: Rosstat service with a list of reporting forms can be misleading!" .

In 2019, a form approved by Rosstat order No. 461 of 27.07.2018 is used to submit the PM form to statistics. The document must be drawn up in accordance with the general instructions for filling out, approved by the same order. Consider the main features of filling out the PM form in statistics according to the instructions in 2019.

ATTENTION! From the report for the 1st quarter of 2020, the form will change (order of Rosstat dated July 22, 2019 No. 419).

Whether to submit zero reporting to Rosstat, find out.

Instructions for filling out the quarterly PM form in statistics (how to fill out a document, what to look for)

The form in question consists of 3 sections.

Section 1 is a questionnaire that reflects the fact of application / non-application of the simplified tax system.

Section 2 reflects the indicators for the number of staff of the company, as well as for the salaries of employees. The reporting entity indicates on the form:

- information on the payroll: qualitative (including distinguishing ordinary workers, external part-time workers and external contractors under contracts) and quantitative;

- the size of the fund of the average accrued wages with its distribution among the main 3 types of employees with the additional allocation of other unscheduled persons;

- the volume of payments of a social nature, also broken down by the main 3 types of workers, with the additional allocation of other persons of unscheduled composition;

- the number of hours worked by the payroll employees during the reporting period.

In sect. 3 forms reflect the main economic indicators of the company for the period (excluding VAT, excise taxes and other mandatory transfers):

- goods, services and works independently produced by the company;

- goods sold by third parties;

- catering products independently produced by the company;

- the cost of purchasing products for resale;

- investments in new and imported fixed assets;

- internal expenditure on research and technological development;

- the cost of resold real estate and the cost of acquiring them.

The PM form includes indicators for the entire company as a legal entity (that is, the document includes figures that summarize the indicators for all divisions).

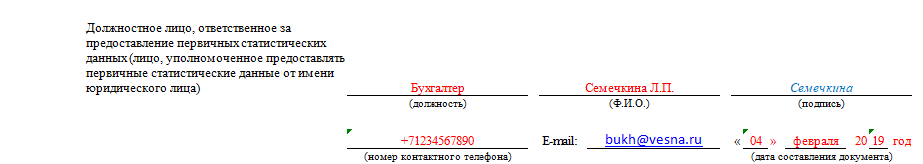

The document is signed by the head of the company or a responsible employee authorized to submit data to Rosstat. A person can be empowered by a separate order of the company's management. The contact details of the person in charge are indicated next to the signature.

For information on what kind of requisite is important for electronically submitted statistical reporting, read the article "Statistics body code for electronic reporting" .

Where can I download the form and a sample of filling out the PM form in statistics in 2019-2020

On our specialized portal you can download.

If the microorganization is not included in the list, then the report in the form 1-mp (micro) for 2017 is not submitted to the state statistics bodies.

Other forms of state statistical reporting applicable to microorganizations, based on the types of activities carried out economic activity are presented in the prescribed manner.

| Reporting on 1-MP ANNUAL Report on the financial and economic activities of a small organization |

|

| Who represents? | Small organizations - commercial organizations with average number employees for the calendar year preceding the reporting year, from 16 to 100 people inclusive. |

| The report is not submitted by: |

|

| Presentation type: | Reports are submitted in the form of an electronic document using |

To classify an organization as a micro-enterprise, its performance indicators must meet certain criteria (Article 4 209-FZ of July 24, 2007):

- the number should be no more than 15 employees;

- income from doing business should not exceed 120 million rubles.

What reports are submitted to the statistics of micro-enterprises in 2019

The activities of small businesses (including microenterprises) are subject to continuous statistical monitoring every five years. The last such observation was in 2016 based on the results of activities for 2015.

In the intervening periods, micro-businesses are subject to only selective observation once a year. Its rules are established by the Government Decree of 16.02.2008 No. 79.

A complete list of statistical reporting for microorganizations is 18 forms. The overwhelming majority of them are associated with specific activities. Basic form: MP (micro); who is obliged to submit a report, we will figure it out below.

To understand whether an organization was included in the sample or not, one should refer to the special resource of Rosstat statreg.gks.ru. On the page that opens, filling in the company data, you can get a list of statistical forms to be submitted. Some regional offices Rosstat publishes a list of organizations included in the sample on their websites. For example, a list of selected organizations in St. Petersburg and the Leningrad Region can be found on the Petrostat page in the Reporting → Statistical reporting → List of reporting business entities.

MP (micro) due date 2019

The statistic we are considering was approved by Rosstat order No. 541 of August 21, 2017. It also contains a brief explanation of how to fill it out.

Form MP (micro)

The date for submitting the report to the MP (micro) is set for February 5. If you are late with the submission of the form, then it is possible to apply penalties. According to article 13.19 of the Code of Administrative Offenses of the Russian Federation, a fine for a company for failure to submit statistical reporting can range from 20,000 to 70,000 rubles.

There are situations when statistics authorities request reports despite the fact that when requesting the resource statreg.gks.ru it is not reflected in the list. In order to avoid penalties, we recommend saving a screenshot of the page. If the report was not named in the list to be submitted on the resource and the company was not notified in writing by Rosstat about the need to submit the report, penalties are not applied.

Also, statistical bodies can request filling out the form MP (micro) - nature. It contains information about the products manufactured, is filled in quantitative terms and is subject to delivery by January 25 of the year following the reporting year.

Blank MP (micro) - nature

Sample report filling

The detailed Instructions of Rosstat on filling out the MP (micro) form were approved by Order No. 723 of November 7, 2017.

The report is filled in according to the basic data of the micro-enterprise's work and consists of a title page and five sections. Information about the organization is filled in on the title page. The sections of the report provide information on:

- taxation system;

- number and payroll;

- the amount of revenue;

- the amount of investment in fixed assets;

- about cargo transportation.

The form is provided by all organizations caught in selective observation, including those that did not conduct activities or were declared bankrupt, if there is no decision regarding them. arbitration court about liquidation.

Non-operating micro-enterprises submit reports with zero values of cost indicators.

Statistical reporting of micro-enterprises is the minimized obligation of organizations with micro-enterprise status to report to the statistical authorities. One of these reports, submitted at the end of the year, is called "Form MP-micro": who should submit this report and in what time frame, this article will tell you.

Statistical reporting applies to absolutely all organizations, regardless of their size. Some reports need to be submitted regularly, in particular, accounting results for the year, and some - after a certain period and only to those respondents who were included in the Rosstat sample. Such a report is the MP-micro form, approved by the Order of Rosstat dated 02.11.2018 No. 654. The report is called "Information on the main indicators of the activity of a micro-enterprise" and is annual. Let's consider its features in more detail.

Form MP-micro: who is obliged to take

This report is intended solely for legal entities which belong to the category of micro-enterprises. These are the organizations that in 2018:

- no more than 15 employees worked;

- the annual income from doing business was no more than 120 million rubles;

- the share of participation of state formations, public and religious organizations and foundations did not exceed 25% in total;

- the share of participation of other companies (including foreign ones) did not exceed 49% in total.

Excess limit values for 3 consecutive calendar years leads to the loss of status.

If a firm fits these parameters, it is necessary to check whether it was included in the sample of statistical observation. This can be done using a special service on the Rosstat website. It is enough for an organization to enter all its data (name, OKPO, TIN or OGRN) into the proposed form and receive information about all reports in statistics that must be submitted in 2019. In addition, Rosstat authorities notify the respondents in the sample in advance about the need to report. Rosstat sends such written notifications to known company addresses.

MP-micro: due date 2019

In 2019, the date for the submission of the MP-micro report for 2018 falls on February 5. No transfers are provided as it is Tuesday. It is this date that appears in the Rosstat Order as the last day for fulfilling the obligation to report. Being late can result in a serious fine.

Features and order of filling

Filling out the MP-micro is not at all difficult, it is drawn up in the form of a questionnaire. In the header, as usual, you must write the details and name of the organization, as well as its postal address.

Further in the MP-micro section 1 goes, in which only one question needs to be answered: does the company apply a simplified taxation system. There are obviously two possible answers: "yes" and "no". Opposite the correct option, you need to put a mark.

The second section in the MP-micro form is more voluminous. It is intended for information on the number and wages workers. To fill it out, you will need to calculate the average headcount, as well as indicate the number of external part-time workers and persons who work under civil law contracts. By the same principle, it is necessary to divide the wage fund. At the end, you need to provide information on social benefits to employees, as well as indicate the number of man-hours worked.

The third section is small and is called “General economic indicators”. You need to fill in information about the shipment of goods, performance of work and services. Also, in the same section, you need to inform the statistics body about investments in fixed assets. All data must be provided in rubles, and VAT and excise taxes must be deducted from the cost.

The fourth section of the MP-micro form is intended for firms that are engaged in wholesale and retail trade or are public catering establishments. It should be noted in it whether or not there are such turnovers, and also indicate their volume for the reporting period.

The final, fifth section of the MP-micro report should be filled out by organizations if they have drivers on their staff and they use any freight or light transport for their needs. Even one car obliges the accountant to complete this section.

At the end, the report must be signed by the accountant who filled it out. You also need to put down the date of filling and indicate your email and phone number.

What reports are submitted to the statistics of micro-enterprises in 2019

In addition to information about the activities of MP-micro organizations, the smallest companies and individual entrepreneurs are required to send other forms to Rosstat:

- balance sheet and form No. 2 (possible in a simplified version) - until 03/31/2019;

- form No. MP (micro) -nature "Information on the production of products by a micro-enterprise" for firms that manufacture products, mining, processing industries, companies that produce and distribute electricity, gas and water, logging, as well as those involved in fishing - until 25.01 .2019 (Order of Rosstat dated July 27, 2018 No. 461);

- annual form No. 1-IP "Information on the activities of an individual entrepreneur" exclusively for individual entrepreneurs - until 03/02/2019.

In addition, other statistical documents may be added depending on the industry in which the firm operates and its field of activity.

Liability for failure

For violation of the deadlines or ignorance of the obligation to submit statistical reports, there are large fines. They are provided article 13.19 of the Code of Administrative Offenses of the Russian Federation, and their size is:

- for officials - from 10,000 to 20,000 rubles;

- for organizations - from 20,000 to 70,000 rubles.

A repeated violation will cost significantly more, the fine rises to 50,000 rubles for officials, and up to 150,000 rubles for legal entities. The statistics body can be held liable within two months from the date of the violation.

The list of reporting forms sent to Rosstat is usually individual for each enterprise or individual entrepreneur. Someone has to submit one or several statistical reports at once in 2018, while someone does not need to submit anything. How to find out what reports should be submitted to statistics in 2018, what these forms are and what is the responsibility for not submitting them, we will tell below.

Who should report to Rosstat

Statistical reporting is provided for any business entities, regardless of their type of activity. Large organizations are required to report regularly; they often submit several reporting forms at once. Representatives of small and medium-sized businesses, as well as micro-enterprises submit statistical reports when they participate in continuous statistical surveys once every 5 years, and in the meantime they can be included in the Rosstat sample according to various criteria - type of activity, volume of revenue, number of employees, etc. (Resolution of the Government of the Russian Federation of February 16, 2008 No. 79).

Reports within the framework of sample studies can be submitted quarterly or monthly, and for micro-enterprises only annual statistical reporting is permissible (clause 5 of article 5 of the law of 24.07.2007 No. 209-FZ).

How to find out which forms of statistical reporting you need to report on

Having formed the sample, the territorial bodies of Rosstat are obliged to notify the individual entrepreneur and the organizations included in it about the need to submit the relevant reports, as well as provide forms for filling out. If there was no such notification, individual entrepreneurs and firms can independently find out on what forms they will have to report in 2018.

How to find out in the statistics body which reports (according to TIN, PSRN or OKPO) need to be submitted in 2018? The easiest and fastest way is to go to the Rosstat website, on the page]]> statreg.gks.ru]]> indicate your status (legal entity, individual entrepreneur, branch, etc.) and enter one of the listed details in the special fields. As a result, the system will generate a list of statistical reporting forms that a person must submit, indicating their name, frequency and deadline for submission. If the list of statistical reporting forms for 2018 is empty, there is no need to report to Rosstat in this period. The information on the site is updated monthly.

Also, a company or individual entrepreneur can apply to the territorial office of Rosstat with an official written request for a list of reporting, but this will take much more time (clause 2 of the Rosstat letter dated January 22, 2018 No. 04-4-04-4 / 6-smi).

Statistical reporting forms and deadlines for their submission

Statforms can be grouped depending on the type of business entity: for example, statistical reporting by individual entrepreneurs, micro-enterprises, medium and small firms, large organizations, there are also forms on which all of the listed entities can report.

Some statistical reports 2018 may only be targeted to certain industries: Agriculture, retail, construction, etc. It is also possible to single out statistical reports presented by the number and composition of personnel, the volume of revenue, manufactured products, etc.

Each statistical form has its own submission deadlines, violation of which can lead to substantial fines (Article 13.19 of the Administrative Offenses Code of the Russian Federation): 10 - 20 thousand rubles. for officials, and 20-70 thousand rubles. For the company. Responsibility for repeated violation of the deadlines for submitting statistical reports will grow to 30-50 thousand rubles. for officials in charge, and up to 100-150 thousand rubles. for the organization. The same penalties apply when submitting inaccurate statistics.

If there are no indicators for filling out the reports, Rosstat must be notified of this by a letter, and it should be written every time the next reporting date occurs (clause 1 of the Rosstat letter dated January 22, 2018 No. 04-4-04-4 / 6-smi).

Along with statistical reports, legal entities are required to submit to Rosstat a copy of the annual accounting. Accounting "statistical" statements (including those in simplified forms) are submitted no later than 3 months after the end of the reporting year (for 2017, the deadline is 02.04.2018). For violation of the term, officials can be fined 300-500 rubles, and the company - 3-5 thousand rubles. (Article 19.7 of the Code of Administrative Offenses of the Russian Federation).

Submission of statistical reports in 2018

Please note that for almost any economic industry and type of activity, many reporting statistics have been developed. Here we provide tables for the actual statistical reporting in 2018, some of them with deadlines.

|

Kind of activity |

Frequency and deadline for submission to Rosstat |

||

Statistical reporting in 2018, submitted regardless of the type of activity: |

|||

|

microenterprises |

|||

|

small businesses |

Quarterly, on the 29th after the reporting quarter |

||

|

legal entity, except SMP |

|||

|

legal entity, except SMP |

|||

|

All types except retail (excluding motor vehicles) |

|||

|

legal entity, except SMP |

|||

|

legal entity, except SMP |

|||

|

legal entity, except SMP |

|||

|

P-2 (invest) |

legal entity, except SMP |

||

|

Monthly, 28th day after the reporting month Quarterly, 30th day after quarter |

|||

|

legal entity, except SMP |

Monthly, with MSS above 15 people. - 15th day of the next month Kvartalnaya, with the SSCH 15 people. and less - on the 15th day after the reporting quarter |

||

|

legal entity with SSH above 15 people, except SMP |

Quarterly, 8 days after the reporting quarter |

||

|

legal entity with SSH above 15 people, except SMP |

Quarterly, 30 days after the reporting quarter |

||

|

legal entity, except SMP |

Quarterly, 20th after the reporting quarter |

||

|

All types, except for insurance, banks, government agencies, financial and credit organizations |

legal entity, except SMP |

Quarterly, 30 days after the reporting period (1Q., Half a year, 9 months.) |

|

|

legal entity, except for SMEs and non-profit organizations |

|||

|

All types, except insurance, private pension funds, banks, government agencies |

legal entity, except SMP |

||

|

legal entity, except SMP |

|||

Submission of statistical reporting in the field of trade: |

|||

|

Wholesale |

SME, except microenterprises |

Monthly, 4th day after the reporting month |

|

|

1-conjuncture |

Retail |

||

|

1-conjuncture (wholesale) |

Wholesale |

Quarterly, 10 day of the last month of the reporting quarter |

|

|

Trade |

legal entity, except microenterprises |

||

|

Wholesale and retail trade |

legal entity, except SMP |

||

|

Sale of goods to the population, repair of household goods |

|||

|

Trade in certain goods |

Individual entrepreneur and legal entity |

||

|

Retail |

SME, except microenterprises |

Quarterly, 15th after the reporting period |

|

Statistical reporting of organizations providing services: |

|||

|

Paid services to the population |

|||

|

Paid services to the population |

legal entities, lawyers 'formations (except for lawyers' offices) |

||

|

1-YES (services) |

legal entity, except micro-enterprises and non-profit organizations |

Quarterly, 15th day of the second month of the reporting quarter |

|

|

Manufacturing and services |

Individual entrepreneurs and legal entities, except microenterprises |

||

What reports to submit to statistics for those who are employed in the field of agriculture: |

|||

|

Agricultural activities |

legal entity, except SMP and KFH |

Monthly, 3rd day after the reporting month |

|

|

Sowing crops |

SMP, KFH, IP |

||

|

Sowing crops, perennial plantings |

SMP, KFH, IP |

||

|

Availability of livestock of agricultural animals |

SMP (monthly), individual entrepreneurs and micro-enterprises (once a year) |

||

|

1-purchase prices |

Agricultural production |

legal entity, except for peasant farms |

|

|

2-purchase prices (grain) |

Purchase of domestic grain for the main production |

Monthly, 15th day of the next month |

|

|

Agricultural activities |

Monthly, 20th of the reporting month |

||

|

1-CX (balance) - urgent |

Purchase, storage, processing of grain and grain products |

Quarterly, 7 days after the reporting quarter |

|

|

10-FUR (short) |

Agricultural activities |

legal entity, except for peasant farms and micro-enterprises |

|

|

Agricultural activity in the presence of sown areas, hayfields, or only perennial plantations |

legal entity, except SMP and KFH |

||

Statistical reporting 2018 - terms for the extractive industry: |

|||

|

Extraction and processing; production and distribution of gas, steam, electricity; fishing, logging |

Individual entrepreneur with employees from 101 people. |

Monthly, 4th working day of the next month |

|

|

Individual entrepreneurs and micro-enterprises with a staff of up to 15 people. |

|||

|

Individual entrepreneurs with employees from 16 to 100 people, small enterprises |

Monthly, 4 business day after the reporting month |

||

|

1-nature-BM |

legal entity, except SMP |

||

|

Mining, manufacturing, air conditioning, gas, steam, electricity |

small businesses |

Quarterly, the 10th of the last month of the quarter |

|

|

legal entity, except SMP |

Monthly, 10th day of the reporting month |

||

|

Mining, manufacturing, air conditioning, gas, steam, electricity, water supply, sewerage, waste collection and disposal, elimination of pollution |

legal entity, except microenterprises |

||

List of statistical reports for the oil and gas industry: |

|||

|

1-TEK (oil) |

Extraction of oil, associated gas and gas condensate |

legal entity, except SMP |

|

|

1-TEK (drill) |

Drilling of the wells |

legal entity, except SMP |

|

|

2-TEK (gas) |

The presence of gas wells on the balance sheet |

legal entity, except SMP |

|

|

Extraction and refining of oil |

legal entity, except SMP |

Quarterly, 30 numbers |

|

|

1-gasoline |

Production of gasoline and diesel fuel |

legal entity, except SMP |

Weekly, 1 day after the reporting week, until 12 noon |

Construction statistics - reports in 2018: |

|||

|

Construction |

legal entity, except microenterprises |

Quarterly, 10 day of the second month of the reporting quarter |

|

|

Construction |

legal entity, except microenterprises |

Monthly, 25th day of the reporting month |

|

|

12-construction |

Construction |

legal entity, except SMP |

|

Statistical reporting of transport enterprises: |

|||

|

Operation and maintenance of urban electric transport |

|||

|

65-autotransport |

Transportation of passengers by buses and light taxis |

legal entity, except microenterprises |

|

|

1-TP (motor transport) |

Transportation of goods by road; non-public roads on the balance sheet |

legal entity, except microenterprises |

|

|

Air transportation |

legal entities and their separate divisions |

Quarterly, 15 days after the reporting quarter |

|

|

Monthly, 7 days after the reporting quarter |

|||

|

Monthly, 15 days after the reporting quarter |

|||

|

32-GA and 33-GA |

Quarterly, 7 days after the reporting quarter |

||

|

1-TARIFF (auto), 1-TARIFF (ha), 1-TARIFF (mor), 1-TARIFF (yellow), 1-TARIFF (pipes), 1-TARIFF (internal water) |

Transportation of goods by road, air, sea, railway, pipeline, water transport |

Monthly, 23rd of the reporting month |

|

Timing of statistical reporting for the tourism and hotel business: |

|||

|

Tourist activities |

Individual entrepreneur and legal entity |

||

|

Services of hotels and similar accommodation facilities |

legal entity, except SMP |

Quarterly, 20 days after the reporting quarter |

|